CPA Services

You can Trust.

You can Trust.

Say goodbye to vague advice, surprise fees, and

outdated accounting strategies and hello to

Proactive Advice, and Clear Communication.

CPA Services

You can Trust.

You can Trust.

Say goodbye to vague advice, surprise fees, and

outdated accounting strategies and hello to

Proactive Advice, and Clear Communication.

outdated accounting strategies and hello to

Proactive Advice, and Clear Communication.

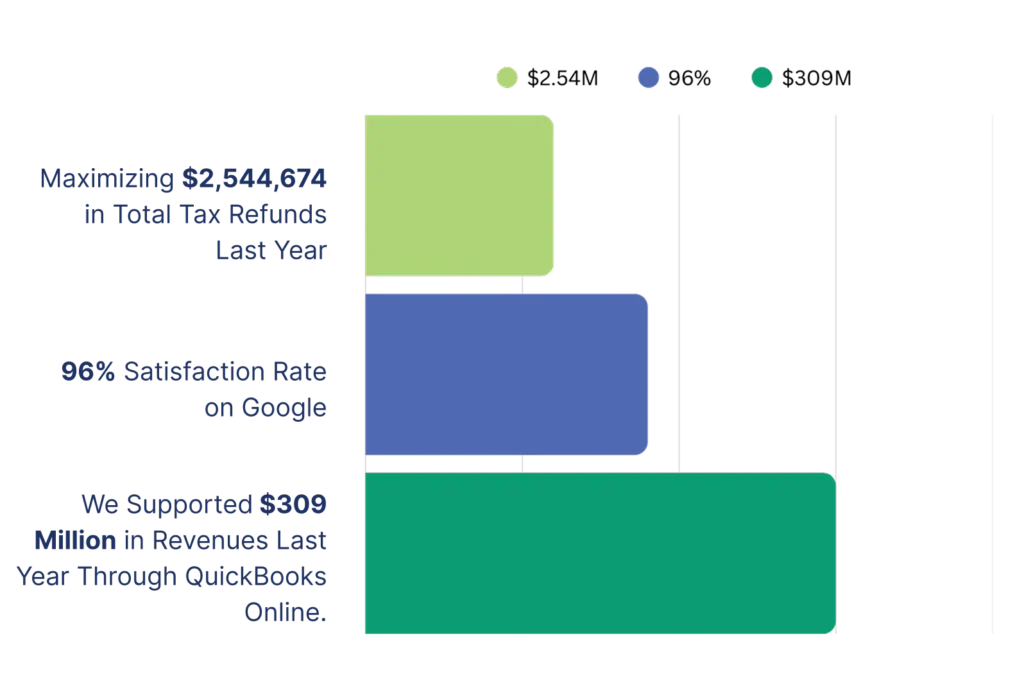

Our Results Are In The Numbers

Our Results Are In

The Numbers

The Numbers

Finding the Right CPA Doesn’t Have to Be Frustrating.

No More Vague Answers

Get clear, timely updates

so you’re always in control.

so you’re always in control.

Tax Strategies That Work

Avoid overpaying taxes with

proactive, tailored planning.

proactive, tailored planning.

A Team Working for You

Full-time professionals providing seamless, year-round support.

Finding the Right CPA Doesn’t Have to Be Frustrating.

No More Vague Answers

Get clear, timely updates

so you’re always in control.

so you’re always in control.

Tax Strategies That Work

Avoid overpaying taxes with

proactive, tailored planning.

proactive, tailored planning.

A Team Working for You

Full-time professionals providing seamless, year-round support.

More Than CPAs—

We’re Your Financial Partners.

We’re Your Financial Partners.

We start with your vision, providing the proactive, personalized attention you deserve.

We start with your vision, providing the proactive, personalized attention

you deserve.

you deserve.

Real Stories. Real Results.

I love Insognia CPA's whole experience! This is the first CPA/firm who has actually been proactive and communicative. Monthly financial summations are great, but best of all are quarterly meetings by me and Insogna CPA leadership. These touchpoints have always been promised by past CPAs, but I ended up chasing the CPA around and even annual meetings (too little too late) were hard to schedule. Not with Insogna, they booked on my calendar and the discussions are very productive, covering all topics from chart of account changes, S-Corp distribution strategies and cash management, a merger which we're going through and more, to ensure everything is handled in a tax efficient way. The recommendations regarding debt management and cash deployment, balancing liquidity with investment that I received from my first quarterly, saves me enough money monthly to cover Insogna CPA fees. And I thought I had my financial act together. But Insogna CPA is full of people who understand business, so I get smart advice. They now made our 'critical vendor' list - a must have if you own a business like I do.

My company and I have been working with Insogna for over a year. They have been a great support to our fast growing business and have worked with me in a number of ways from catching up on back taxes, tax prep, strategy advice, and more - being flexible and adapting to our unique needs. I communicate often with several of the team members, all of which are pleasant to work with and most importantly demonstrate they are experienced at what they do and the way they operate. Definitely recommend.

They have become like family. We’ve been working with Insogna CPA for many years for our company and personal bookkeeping/tax needs. We couldn't imagine switching CPA firms again. Their team is professional, reliable, and truly essential to the growth of our companies. Their expertise and guidance have made a significant impact, allowing us to focus on what we do best. We highly recommend them to any business or person looking for top-notch accounting and tax support!

Insogna did a great job! They handled the combo of W-2 and investment income plus independent consulting income with ease. I just sent them all the info (via their online portal) and ended up getting back $8k thanks to all the deductions they found. Thanks team!

As a new small business owner I am EXTREMELY grateful for Insogna CPA. They have not only handled my account but they have taught me so much! They are very personable and make me feel like I am their only client. Their communication is SUPERB which is very important to me. I could not have asked for a better team than the one at Insogna CPA.

I've used Insogna CPA's bookkeeping, tax preparation, and professional services for my business (Bravery Media) and personal finances since 2012. They have always been helpful, quick to respond, and impeccable in their work. As a small business owner, it's nice to not have to worry about accounting while I'm trying to generate more business. I've recommended Chase and his staff to dozens of people since I started working with them.

Real Stories.

Real Results.

Real Results.

They have become like family. We’ve been working with Insogna CPA for many years for our company and personal bookkeeping/tax needs. We couldn't imagine switching CPA firms again. Their team is professional, reliable, and truly essential to the growth of our companies. Their expertise and guidance have made a significant impact, allowing us to focus on what we do best. We highly recommend them to any business or person looking for top-notch accounting and tax support!

As a new small business owner I am EXTREMELY grateful for Insogna CPA. They have not only handled my account but they have taught me so much! They are very personable and make me feel like I am their only client. Their communication is SUPERB which is very important to me. I could not have asked for a better team than the one at Insogna CPA.

I've used Insogna CPA's bookkeeping, tax preparation, and professional services for my business (Bravery Media) and personal finances since 2012. They have always been helpful, quick to respond, and impeccable in their work. As a small business owner, it's nice to not have to worry about accounting while I'm trying to generate more business. I've recommended Chase and his staff to dozens of people since I started working with them.

No Surprises,

Just Clear Pricing.

Just Clear Pricing.

We believe in straightforward pricing with no hidden fees. Explore packages tailored

to your business.

to your business.

No Surprises,

Just Clear Pricing.

Just Clear Pricing.

We believe in straightforward pricing with no hidden fees. Explore packages tailored to your business.

The CPA Firm That Works

as Hard as You Do

as Hard as You Do

Don’t settle for a CPA who’s just good enough.

At Insogna, we’re your proactive financial partner—delivering the clarity, strategies, and seamless support your business deserves.

Let’s eliminate surprises, take the stress off your plate, and help you stay ahead.

Ready to experience the Insogna difference?

At Insogna, we’re your proactive financial partner—delivering the clarity, strategies, and seamless support your business deserves.

Let’s eliminate surprises, take the stress off your plate, and help you stay ahead.

Ready to experience the Insogna difference?

The CPA Firm That

Works as Hard

as You Do

Works as Hard

as You Do

Don’t settle for a CPA

who’s just good enough.

At Insogna, we’re your proactive financial partner—delivering the clarity, strategies, and seamless support your business deserves.

Let’s eliminate surprises, take the stress off your plate, and

help you stay ahead.

who’s just good enough.

At Insogna, we’re your proactive financial partner—delivering the clarity, strategies, and seamless support your business deserves.

Let’s eliminate surprises, take the stress off your plate, and

help you stay ahead.

Ready to experience

stress free accounting?

stress free accounting?