no missed deadlines

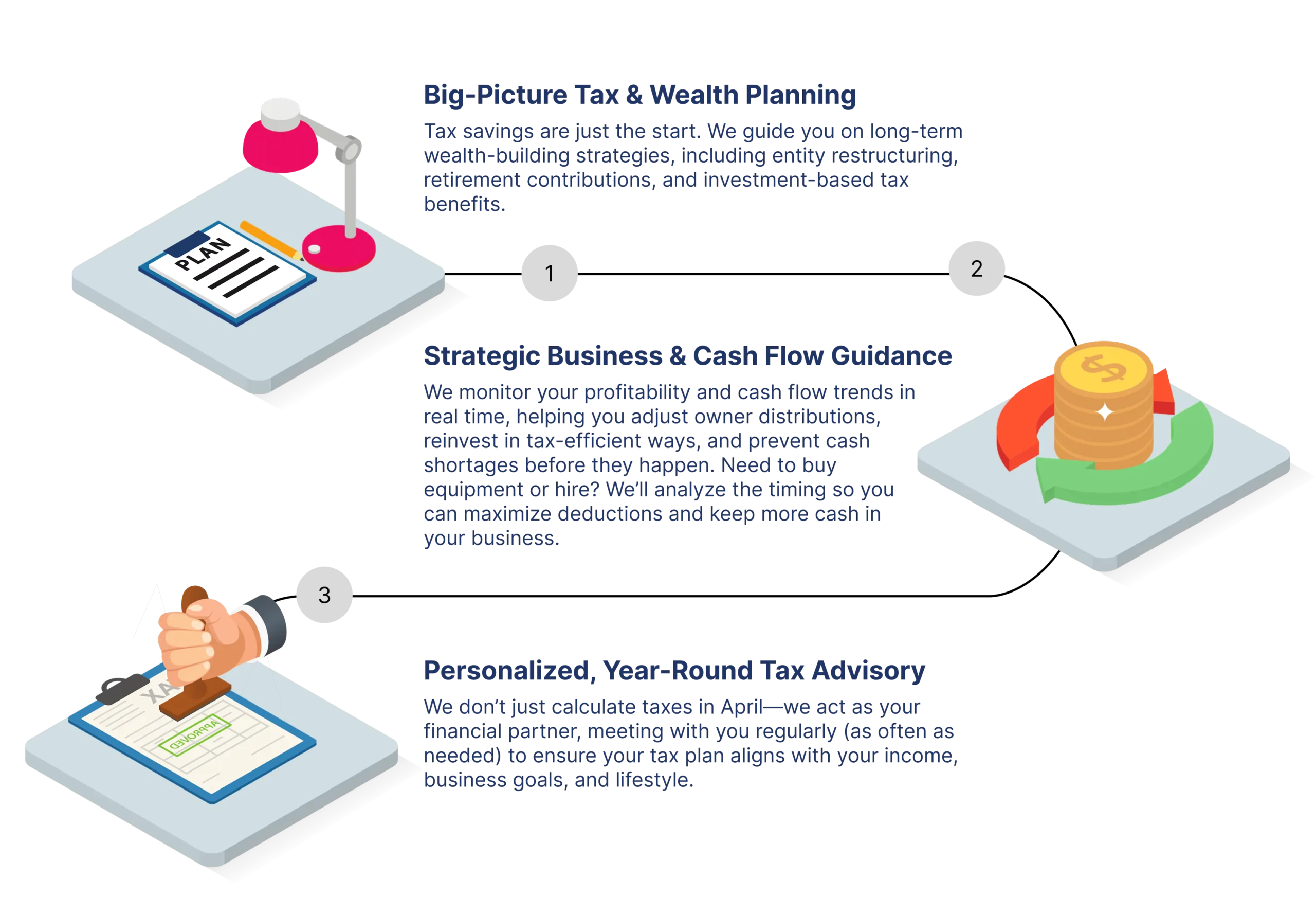

Most CPAs just file your taxes. We build proactive tax strategies that help business owners, investors, and high-income earners legally keep more of what they earn—without waiting until tax season to figure it out.

✅ Business Owners & Entrepreneurs

>Reduce FICA self-employment tax and choose the best legal structure Disregarded Entity, S-Corp, Partnership, or C-Corp. Looking for advanced strategies? A 412(e) plan lets business owners over 50 contribute up to $400K annually, fully deductible. Need bigger deductions? A corporate jet purchase could unlock significant tax savings.

✅ Real Estate Investors

>Real estate investors can legally reduce taxable income while boosting cash flow. Have you considered doing a Cost Segregation Study to accelerate depreciation or doing a 1031 exchange to defer capital gains when selling, and other real estate tax loopholes.

✅ High-Income Earners ($500K+ Annual Income)

>If you're earning over $500K, tax-saving opportunities go beyond 401K’s and IRA’s. Have you considered tax mitigation strategies like Oil & Gas Partnerships, Exotic Wildlife Conservation Funds, and Solar Investments that leverage the Inflation Reduction Act? All of these (and more!) provide immediate tax benefits and potential full ROI.

✅ Multi-State Business Owners & High-Income Individuals

>For S-Corps and Partnerships, paying state taxes through your entity—not your personal return—can save thousands annually. But this must be typically done before Dec 31st—if your CPA isn’t advising on this, you’re leaving money on the table.

We Help You Build

Long-Term Wealth

How is tax advisory different from tax preparation?

Tax preparation is about filing your taxes correctly—but tax advisory is about strategically reducing what you owe throughout the year.

How do you track my financials in real time?

We integrate daily bookkeeping, AI-driven advisory tools, and regularly scheduled calls with you to ensure your plan stays up-to-date.

When do you do tax planning check-ins?

We do quarterly tax strategy reviews, plus a custom Q4 tax analysis to ensure you maximize savings before December 31st.

Can you help adjust my W-2 salary to optimize taxes?

Yes! We track net profits and cash flow monthly so we can adjust your salary and distributions in real time to prevent overpaying payroll taxes.

How is tax advisory different from tax preparation?

Tax preparation is about filing your taxes correctly—but tax advisory is about strategically reducing what you owe throughout the year.

How do you track my financials in real time?

We integrate daily bookkeeping, AI-driven advisory tools, and regularly scheduled calls with you to ensure your plan stays up-to-date.

When do you do tax planning check-ins?

We do quarterly tax strategy reviews, plus a custom Q4 tax analysis to ensure you maximize savings before December 31st.

Can you help adjust my W-2 salary to optimize taxes?

Yes! We track net profits and cash flow monthly so we can adjust your salary and distributions in real time to prevent overpaying payroll taxes.