Most CPAs File Taxes—

We Help You Pay Less

Tax Prep Should Be More Than Just Filing—It Should Save You Money

Most CPAs focus on filing taxes—but that’s not where the real savings happen. The key to lowering your tax bill is proactive tax planning—making smart financial moves throughout the year to ensure you’re keeping as much of your income as legally possible. That’s what we do at Insogna with our monthly

business services.

Year Round

Tax-Planning

Maximizing

Deductions &

Credits

Tax Compliance Without the

Stress

Tax Prep Should Be More Than Just Filing—It Should Save

You Money

You Money

Most CPAs focus on filing taxes—but that’s not where the real savings happen. The key to lowering your tax bill is proactive tax planning—making smart financial moves throughout the year to ensure you’re keeping as much of your income as legally possible. That’s what we do at Insogna with our monthly

business services.

Year Round

Tax-Planning

Maximizing

Deductions & Credits

Deductions & Credits

Tax Compliance Without

the Stress

the Stress

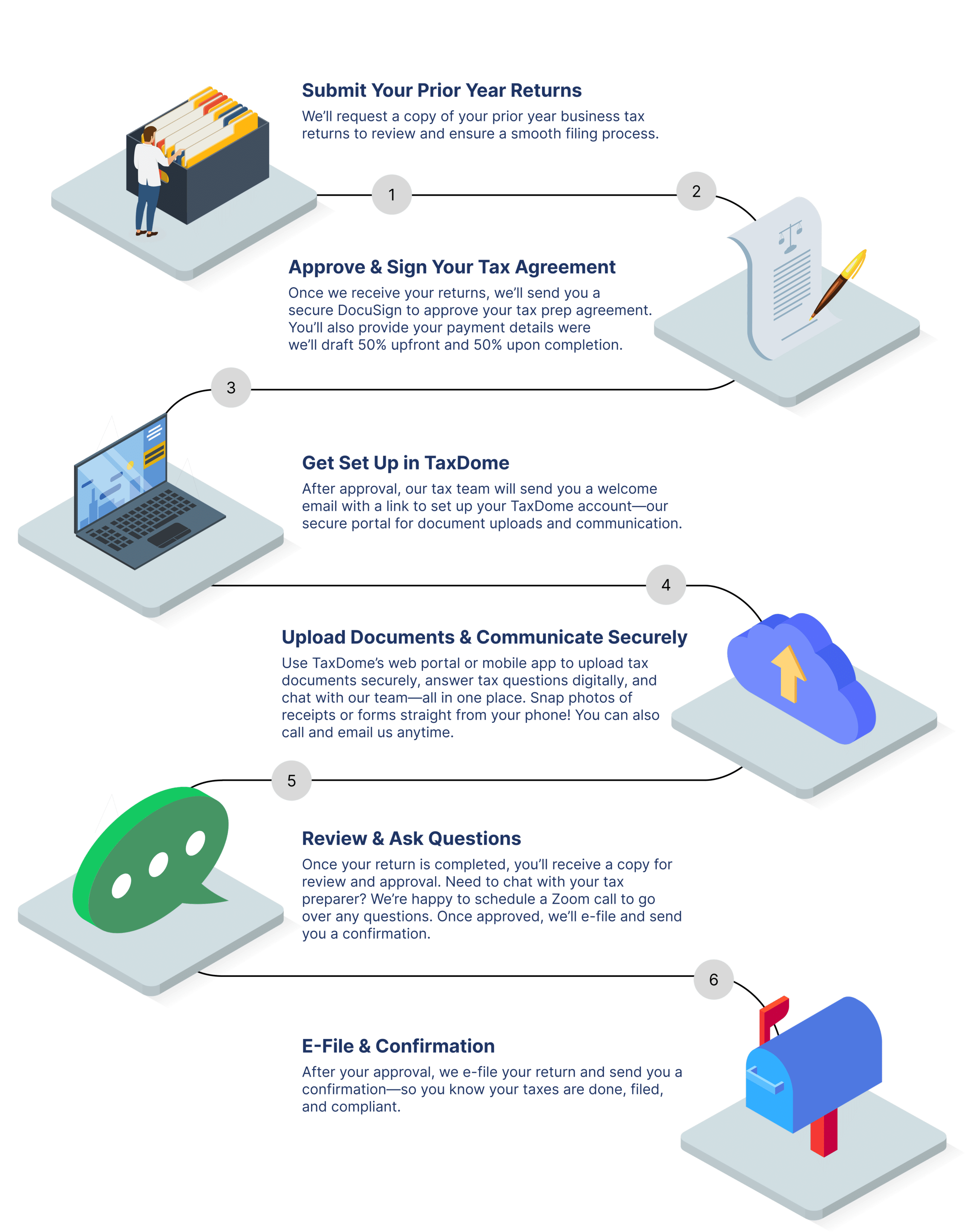

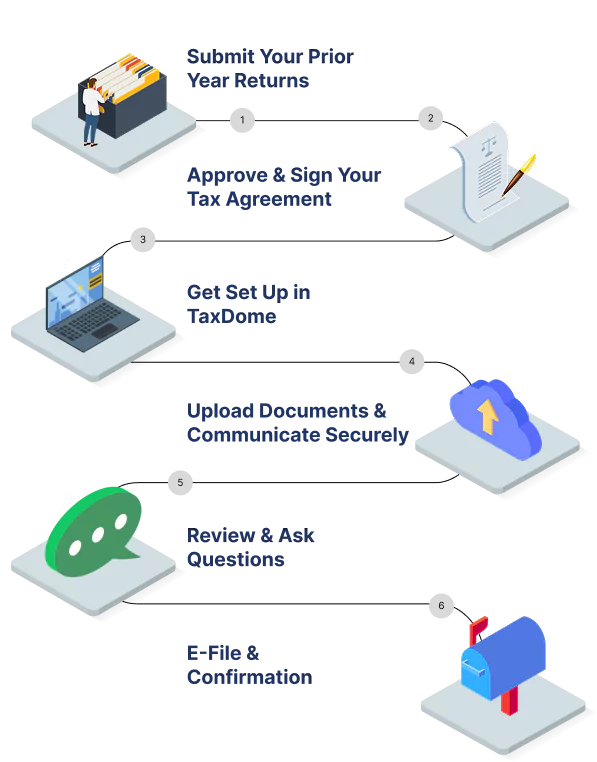

How We Help You Stay Ahead—Without the Stress

Our structured process ensures accuracy, security, and clear communication at

every step—so you always know where your tax return stands.

every step—so you always know where your tax return stands.

How We Help You Stay Ahead—Without

the Stress

the Stress

Frequently Asked Questions (FAQs)

💡

How do I get started with Insogna CPA for my business taxes?

How do I get started with Insogna CPA for my business taxes?

✅

It’s easy! Just upload your prior-year tax return, sign your DocuSign tax prep agreement, and set up your secure TaxDome portal. From there, we guide you step by step.

It’s easy! Just upload your prior-year tax return, sign your DocuSign tax prep agreement, and set up your secure TaxDome portal. From there, we guide you step by step.

💡

What makes Insogna CPA different from other tax firms?

What makes Insogna CPA different from other tax firms?

✅

We’re proactive, not just preparers. Our CPA team ensures your business is structured for maximum tax savings, while our secure, digital-first process eliminates the usual tax season chaos.

We’re proactive, not just preparers. Our CPA team ensures your business is structured for maximum tax savings, while our secure, digital-first process eliminates the usual tax season chaos.

💡

Can I ask questions before filing my return?

Can I ask questions before filing my return?

✅

Absolutely! We’re here for you. Before filing, we’ll send your return for review, and if you have any questions, we’re happy to schedule a Zoom call with your tax preparer.

Absolutely! We’re here for you. Before filing, we’ll send your return for review, and if you have any questions, we’re happy to schedule a Zoom call with your tax preparer.

💡

How do I securely upload my tax documents?

How do I securely upload my tax documents?

✅

We use TaxDome, a secure client portal and mobile app that lets you upload documents, chat with our team, and track your tax progress—all in one place.

We use TaxDome, a secure client portal and mobile app that lets you upload documents, chat with our team, and track your tax progress—all in one place.

💡

When do I pay for my tax preparation?

When do I pay for my tax preparation?

✅

50% upfront, 50% upon completion. We’ll securely ACH draft payments to ensure a seamless process—no surprise invoices.

50% upfront, 50% upon completion. We’ll securely ACH draft payments to ensure a seamless process—no surprise invoices.

Frequently Asked Questions (FAQs)

💡

How do I get started with Insogna CPA for my business taxes?

How do I get started with Insogna CPA for my business taxes?

✅

It’s easy! Just upload your prior-year tax return, sign your DocuSign tax prep agreement, and set up your secure TaxDome portal. From there, we guide you step by step.

It’s easy! Just upload your prior-year tax return, sign your DocuSign tax prep agreement, and set up your secure TaxDome portal. From there, we guide you step by step.

💡

What makes Insogna CPA different from other tax firms?

What makes Insogna CPA different from other tax firms?

✅

We’re proactive, not just preparers. Our CPA team ensures your business is structured for maximum tax savings, while our secure, digital-first process eliminates the usual tax season chaos.

We’re proactive, not just preparers. Our CPA team ensures your business is structured for maximum tax savings, while our secure, digital-first process eliminates the usual tax season chaos.

💡

Can I ask questions before filing my return?

Can I ask questions before filing my return?

✅

Absolutely! We’re here for you. Before filing, we’ll send your return for review, and if you have any questions, we’re happy to schedule a Zoom call with your tax preparer.

Absolutely! We’re here for you. Before filing, we’ll send your return for review, and if you have any questions, we’re happy to schedule a Zoom call with your tax preparer.

💡

How do I securely upload my tax documents?

How do I securely upload my tax documents?

✅

We use TaxDome, a secure client portal and mobile app that lets you upload documents, chat with our team, and track your tax progress—all in one place.

We use TaxDome, a secure client portal and mobile app that lets you upload documents, chat with our team, and track your tax progress—all in one place.

💡

When do I pay for my tax preparation?

When do I pay for my tax preparation?

✅

50% upfront, 50% upon completion. We’ll securely ACH draft payments to ensure a seamless process—no surprise invoices.

50% upfront, 50% upon completion. We’ll securely ACH draft payments to ensure a seamless process—no surprise invoices.

I have used Insogna for my businesses accounting needs for a few years now. I have been thoroughly impressed. They are professional, knowledgeable, prompt, and great folks to work with. I highly recommended this team for your accounting needs!

Insogna CPA has stepped up to the plate again this year and finished my returns on time and with guidance on ways to save my company $ this new tax year. I love the honesty and reliability this CPA has to look out for what is best for my company and personal return each year. From a small business perspective working with Insogna CPA has made my tax filing each year much easier to handle. Thanks Chase!

As a new small business owner I am EXTREMELY grateful for Insogna CPA. They have not only handled my account but they have taught me so much! They are very personable and make me feel like I am their only client. Their communication is SUPERB which is very important to me. I could not have asked for a better team than the one at Insogna CPA.

I am a small business owner and have been overwhelmed with doing my own books and dealing with non communicative and untimely accountants. I have found Chase and have been very happy with his services. His tax returns are timely, he is fast to respond to your emails even outside of regular working hours.

Just the other day he saw some trends in my business and asked to meet with me without my prompt. He dedicated an entire hour and gave us pertinent and actionable advice to make our business more efficient and profitable.

If you are looking for a professional, timely and serious CPA look no more!

My company and I have been working with Insogna for over a year. They have been a great support to our fast growing business and have worked with me in a number of ways from catching up on back taxes, tax prep, strategy advice, and more - being flexible and adapting to our unique needs. I communicate often with several of the team members, all of which are pleasant to work with and most importantly demonstrate they are experienced at what they do and the way they operate. Definitely recommend.

Just the other day he saw some trends in my business and asked to meet with me without my prompt. He dedicated an entire hour and gave us pertinent and actionable advice to make our business more efficient and profitable.

If you are looking for a professional, timely and serious CPA look no more!

Let’s Make Tax Season

Simple & Stress-Free

With a structured, secure, and proactive tax process, you’ll always know where your return stands. No last-minute scrambling. No IRS surprises. Just expert tax preparation designed to help you keep more of what you earn.

Let’s Make Tax Season

Simple & Stress-Free

With a structured, secure, and proactive tax process, you’ll always know where your return stands. No last-minute scrambling. No IRS surprises. Just expert tax preparation designed to help you keep more of what you earn.