Own Rental Property?

Let’s Maximize Your

Tax Savings

Let’s Maximize Your

Tax Savings

$100M+

in Rental Income Managed for Clients

97%

Client Satisfaction—5-Star Rated Real Estate Tax Services

100%

️Real Estate CPA Expertise—Beyond Basic Tax Software

Who We Help:

Whether you own a single rental property or a portfolio of income-producing real estate, you need a Certified Public Accountant (CPA) who understands real estate tax strategy firsthand. Our founder owns 15 rental properties, and our tax team is highly trained to maximize deductions, structure filings efficiently, and keep more money in your pocket.

First-Time & Small-Scale Landlords

Get every deduction you’re entitled to—tax software won’t ask the right questions, but we do. Plus, we ensure you fully capture depreciation deductions to lower your tax bill.

Short-Term Rental (Airbnb, VRBO) Owners

Take advantage of tax deductions for self-employed business owners.

Multi-Property Investors & Real Estate Professionals

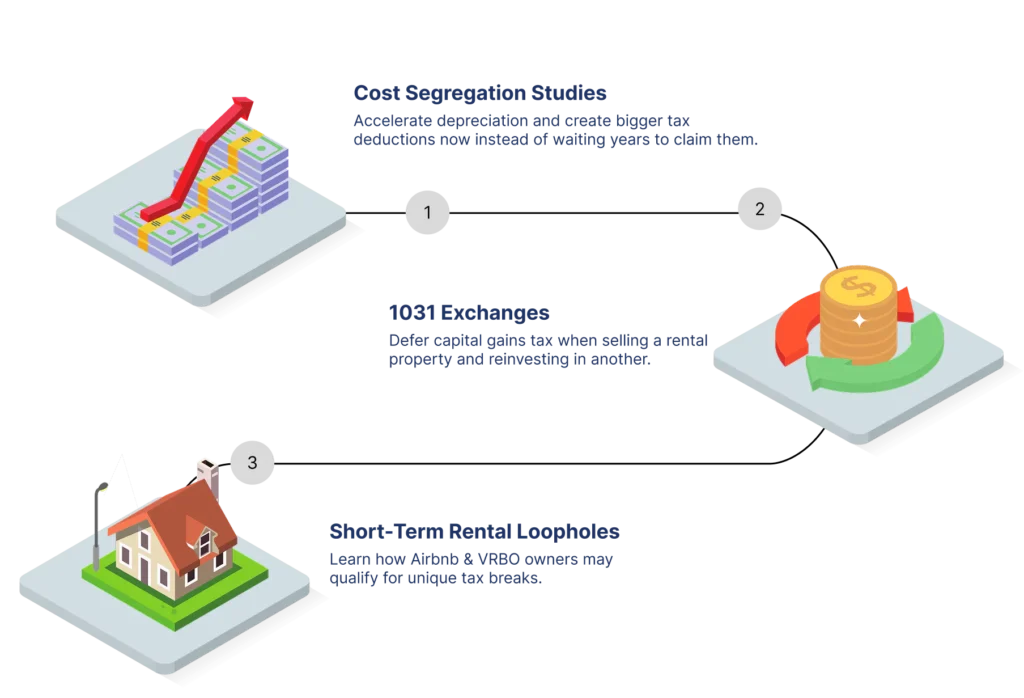

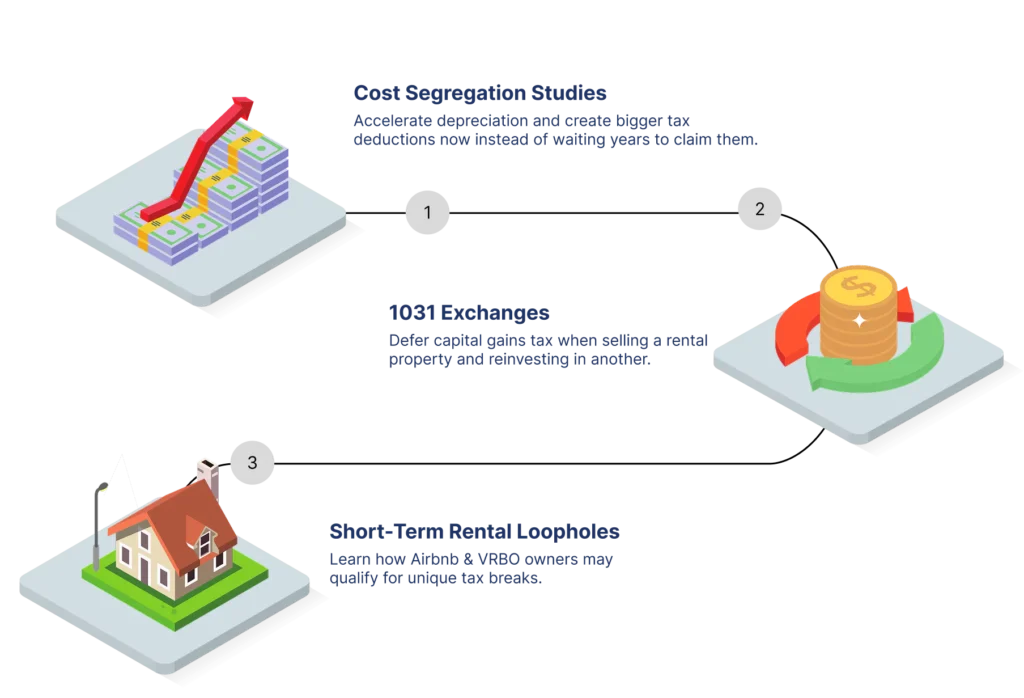

Implement advanced tax strategies like cost segregation to accelerate depreciation and 1031 exchanges to defer capital gains taxes.

Own Rental Property?

Let’s Maximize Your

Tax Savings

Tax Savings

Who We Help:

Whether you own a single rental property or a portfolio of income-producing real estate, you need a Certified Public Accountant (CPA) who understands real estate tax strategy firsthand. Our founder owns 15 rental properties, and our tax team is highly trained to maximize deductions, structure filings efficiently, and keep more money in your pocket.

First-Time & Small-Scale Landlords

Get every deduction you’re entitled to—tax software won’t ask the right questions, but we do. Plus, we ensure you fully capture depreciation deductions to lower your tax bill.

Short-Term Rental (Airbnb, VRBO) Owners

Take advantage of tax deductions for self-employed business owners.

Multi-Property Investors & Real Estate Professionals

Implement advanced tax strategies like cost segregation to accelerate depreciation and 1031 exchanges to defer capital gains taxes.

Most Landlords Miss Out on Tax Savings—Are You?

If you own rental property, you could be overpaying in taxes without realizing it. Many landlords miss deductions, miscalculate depreciation, or overlook tax-saving strategies like a 1031 exchange. Our tax CPA team specializes in rental property taxation, ensuring you maximize every deduction while minimizing IRS audit risks.

Most Landlords Miss Out on Tax Savings—Are You?

If you own rental property, you could be overpaying in taxes without realizing it. Many landlords miss deductions, miscalculate depreciation, or overlook tax-saving strategies like a 1031 exchange. Our tax CPA team specializes in rental property taxation, ensuring you maximize every deduction while minimizing IRS audit risks.

Key Strategies We Use to Lower Your Taxes

Owning rental property isn’t just about collecting rent—you own this rental to save on taxes. It’s about making sure your tax strategy works in your favor. Our tax preparers specialize in real estate, helping investors legally reduce their tax burden while building long-term wealth.

Self-Employed?

Maximize Tax Savings

with your Schedule C

Once your Schedule C net profit exceeds $60,000, an LLC with an S-Corp tax election could help save you thousands in unnecessary FICA payroll taxes by allowing you to split your income into a salary + distributions.

Frequently Asked Questions (FAQs)

💡

What expenses can I deduct on Schedule E?

What expenses can I deduct on Schedule E?

✅

Mortgage interest, property management fees, repairs, depreciation, utilities, HOA fees, and more—we ensure you claim every deduction legally available that tax software can miss.

Mortgage interest, property management fees, repairs, depreciation, utilities, HOA fees, and more—we ensure you claim every deduction legally available that tax software can miss.

💡

How does depreciation reduce my rental income tax?

How does depreciation reduce my rental income tax?

✅

Depreciation allows you to deduct a portion of your property’s value each year, lowering your taxable income—without affecting cash flow.

Depreciation allows you to deduct a portion of your property’s value each year, lowering your taxable income—without affecting cash flow.

💡

What’s the difference between rental income and passive income for tax purposes?

What’s the difference between rental income and passive income for tax purposes?

✅

Short-term rentals (Airbnb, VRBO) that are rented 7 days or less may be classified as active income, while long-term rentals are passive income—which impacts how they’re taxed.

Short-term rentals (Airbnb, VRBO) that are rented 7 days or less may be classified as active income, while long-term rentals are passive income—which impacts how they’re taxed.

💡

Can you help with 1031 exchanges?

Can you help with 1031 exchanges?

✅

Yes! We assist with 1031 exchange tax planning, ensuring you defer capital gains tax while reinvesting in new properties.

Yes! We assist with 1031 exchange tax planning, ensuring you defer capital gains tax while reinvesting in new properties.

Frequently Asked Questions (FAQs)

💡

What expenses can I deduct on Schedule E?

What expenses can I deduct on Schedule E?

✅

Mortgage interest, property management fees, repairs, depreciation, utilities, HOA fees, and more—we ensure you claim every deduction legally available that tax software can miss.

Mortgage interest, property management fees, repairs, depreciation, utilities, HOA fees, and more—we ensure you claim every deduction legally available that tax software can miss.

💡

How does depreciation reduce my rental income tax?

How does depreciation reduce my rental income tax?

✅

Depreciation allows you to deduct a portion of your property’s value each year, lowering your taxable income—without affecting cash flow.

Depreciation allows you to deduct a portion of your property’s value each year, lowering your taxable income—without affecting cash flow.

💡

What’s the difference between rental income and passive income for tax purposes?

What’s the difference between rental income and passive income for tax purposes?

✅

Short-term rentals (Airbnb, VRBO) that are rented 7 days or less may be classified as active income, while long-term rentals are passive income—which impacts how they’re taxed.

Short-term rentals (Airbnb, VRBO) that are rented 7 days or less may be classified as active income, while long-term rentals are passive income—which impacts how they’re taxed.

💡

Can you help with 1031 exchanges?

Can you help with 1031 exchanges?

✅

Yes! We assist with 1031 exchange tax planning, ensuring you defer capital gains tax while reinvesting in new properties.

Yes! We assist with 1031 exchange tax planning, ensuring you defer capital gains tax while reinvesting in new properties.

Our first year using Insogna CPA. They did an outstanding job. They were responsive, understanding, and proactive. Chase and his team have been very supportive, especially at this time, and helped us with our business transitions. They respond quickly and professionally. They assisted us with critical decisions and planning, working on our accounting, tax and payroll needs..

Update 2/28/2023

After several years now, Insogna CPA is consistently providing us with outstanding service for both business and person taxes and accounting.

The Insogna team has not only met but exceeded my expectations in every way possible. From the initial consultation to the final delivery of services, their professionalism, expertise, and dedication truly stood out.

The Insogna team representatives not only met my expectations but continually exceeded them in every way. I would highly recommend your services to anyone in need of expert financial guidance and support. Insognas dedication to client satisfaction and exceptional level of service make them a valuable asset to any team.

I am a small business owner and have been overwhelmed with doing my own books and dealing with non communicative and untimely accountants. I have found Chase and have been very happy with his services. His tax returns are timely, he is fast to respond to your emails even outside of regular working hours.

Just the other day he saw some trends in my business and asked to meet with me without my prompt. He dedicated an entire hour and gave us pertinent and actionable advice to make our business more efficient and profitable.

If you are looking for a professional, timely and serious CPA look no more!

Real Tax Savings for

Real Estate Clients like You

Real Estate Clients like You

Real Tax Savings for Real Estate Clients like You