Navigating Partnership

Taxes Doesn't Have

to Be Overwhelming

Taxes Doesn't Have

to Be Overwhelming

Are These Tax Challenges Impacting Your Partnership?

Complex Compliance Requirements

Staying updated with ever-changing tax laws is time-consuming and risky.

Accurate

Income

Reporting

Ensuring all income is accurately reported to avoid IRS penalties.

Timely Filing to Avoid Penalties

Missing deadlines can result in significant fines.

Proper Allocation of Income & Deductions

Ensuring each partner's share aligns with the partnership agreement.

Navigating Partnership Taxes Doesn't Have to Be Overwhelming

Are These Tax Challenges Impacting Your Partnership?

Complex Compliance Requirements

Staying updated with ever-changing tax laws is time-consuming and risky.

Accurate

Income

Reporting

Ensuring all income is accurately reported to avoid IRS penalties.

Timely Filing to Avoid Penalties

Missing deadlines can result in significant fines.

Proper Allocation of Income and Deductions

Ensuring each partner's share aligns with the partnership agreement.

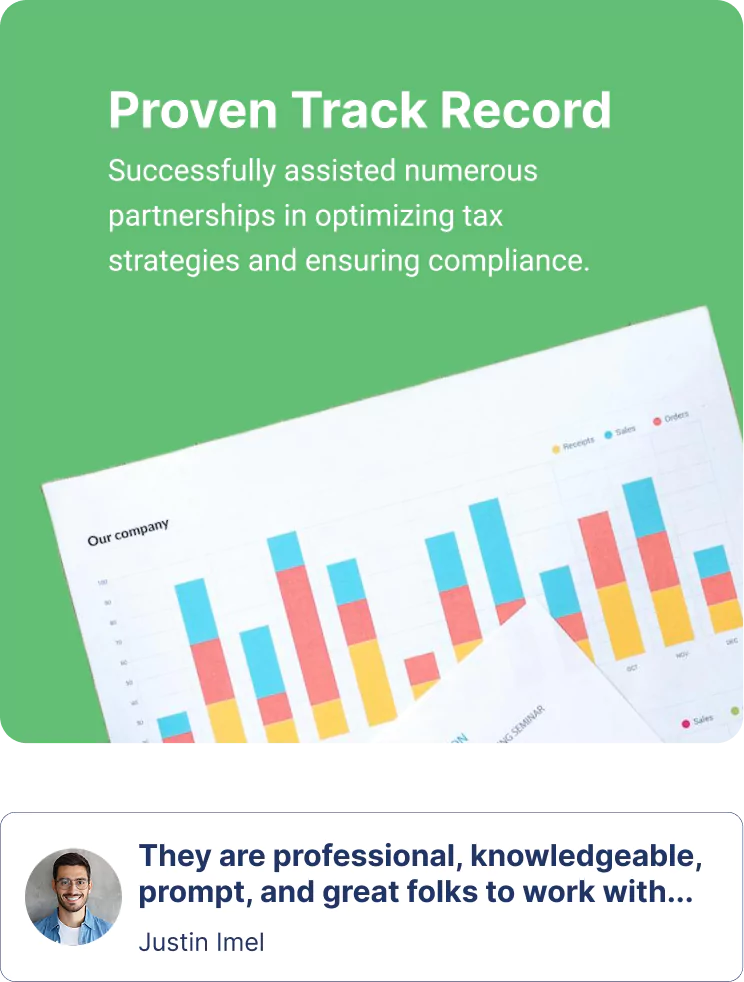

How We Help Build Scalable Financial Infrastructure:

Form 1065 is the U.S. Return of Partnership Income. All domestic partnerships are required to file this form annually to report income, deductions, and other tax-related information.

Form 1065 is typically due by the 15th day of the third month after the end of the tax year, usually March 15 for calendar-year taxpayers.

Failing to file Form 1065 on time can result in penalties, including a $220 per-month, per-partner penalty for late filing, up to a maximum of 12 months.

Our first year using Insogna CPA. They did an outstanding job. They were responsive, understanding, and proactive. Chase and his team have been very supportive, especially at this time, and helped us with our business transitions. They respond quickly and professionally. They assisted us with critical decisions and planning, working on our accounting, tax and payroll needs..

Update 2/28/2023

After several years now, Insogna CPA is consistently providing us with outstanding service for both business and person taxes and accounting.

The Insogna team has not only met but exceeded my expectations in every way possible. From the initial consultation to the final delivery of services, their professionalism, expertise, and dedication truly stood out.

The Insogna team representatives not only met my expectations but continually exceeded them in every way. I would highly recommend your services to anyone in need of expert financial guidance and support. Insognas dedication to client satisfaction and exceptional level of service make them a valuable asset to any team.

I am a small business owner and have been overwhelmed with doing my own books and dealing with non communicative and untimely accountants. I have found Chase and have been very happy with his services. His tax returns are timely, he is fast to respond to your emails even outside of regular working hours.

Just the other day he saw some trends in my business and asked to meet with me without my prompt. He dedicated an entire hour and gave us pertinent and actionable advice to make our business more efficient and profitable.

If you are looking for a professional, timely and serious CPA look no more!

Ready to Simplify Your Partnership Taxes?

Let our experienced CPAs handle the complexities of your partnership tax filings, so you can focus on growing your business.