Featured Pages

5 Ways an Outsourced CFO Makes You a Rockstar CEO

Ever feel like you’re juggling a million tasks at your business? Marketing, sales, operations – it’s enough to make any business owner want to pull their hair out.

Top 3 Accounting Firm in Austin TX: Insogna CPA

Looking for the best Austin Accounting Firm? For the fourth year in a row, Insogna CPA has been recognized as a Top 3 Accounting Firm in Austin, Texas.

Business Owners: 5 Reasons Why a Licensed CPA is Your Secret Weapon

Running your own business is a lot. You’re the boss, calling the shots and chasing your dreams. That’s where a licensed CPA steps in as your secret weapon.

Licensed CPA Accountant vs. Unlicensed Tax Preparer

Did you know: Anyone with a high school diploma can pay the IRS a small fee and become a “tax expert” filing your income taxes. Are you certain you want to leave your most intimate financial details to someone who has no recourse?

The 2024 Guide to Sales Tax for Online Sellers: What Every Business Needs to Know

Sales tax is not a straightforward subject; in fact, it has a lot of moving parts. When it comes to sales tax for online sellers, things can get even more complicated.

Vacation Home Rental Property: Income Tax Rules for 2024

These rental tax rules include some interesting twists that you should know about before you begin renting. While some individuals prefer never to rent out their vacation homes, others find such rentals to be a helpful way of covering the property taxes and other costs of the home.

How to Avoid a Tax Audit for Small Business Owners

Small business bookkeeping can be challenging and full of obstacles, but you can increase your chances of avoiding an IRS tax audit by understanding what accounting mistakes generally trigger suspicion and how to avoid them.

Should I do my own Taxes in 2024 or Hire a Licensed CPA?

In the past, I’ve had a “tax professional” handle my personal and business taxes. However, lately, I suspect I might be missing out on some deductions that could increase my return.

Where’s my IRS tax refund? Reasons Why IRS Isn’t Responding

If you’re still waiting for a tax refund or have tried to contact the IRS directly in 2024, here are six reasons why you might not be getting a response.

Do I need a Certified Public Accountant (CPA) for my eCommerce Business?

Hiring the right eCommerce CPA accounting firm to contribute to your team’s success is crucial. It takes time, expertise, and diligence to find the perfect match for your growing eCommerce or online retail business.

Guide to Dropshipping and Sales Tax in 2024: For Retailers and Online Businesses

If you’re still waiting for a tax refund or have tried to contact the IRS directly in 2024, here are six reasons why you might not be getting a response.

What is the Difference between a Virtual Controller and a Fractional CFO?

Not sure what your business really needs? Your business might not need a full-time financial guru clocking 40 hours a week in the year 2024.

Amazon FBA Seller Tax Guide and Tips you need to know in 2024

If you put in some real effort, you can use this outlet to become a very successful online merchant. However, an inexperienced Amazon seller filing taxes might not know that there are nuances to the task that might not be immediately intuitive.

What is the NEW FinCEN’s Reporting Rule: Things Your LLC/INC Needs to Know

Starting January 1, 2024, FinCEN’s Beneficial Ownership Information Reporting Rule comes into effect. This rule ensures transparency in business ownership by requiring companies to report key information to the U.S. Government.

Beyond Automated Bookkeeping: How to get the most of your CPA Accountant

The rise of automation has been a game-changer for many businesses, enabling them to cut costs and streamline operations in 2024. Have you ever considered why your small business needs more than just automated bookkeeping?

2024 Legal Tax Tips: 5 Ways to Reduce Your Tax Bill

Taxes can be stressful, and it may be tempting to procrastinate—don’t give in to that temptation. By thinking ahead and working with an expert, you can turn the hassle of doing your taxes into an opportunity to keep some of your hard-earned income in your pocket where it belongs.

Discover 5 Tax Credits Every Small Business Owner Can Claim in 2024

Running a business comes with many financial responsibilities, and paying taxes is a significant one. While it might seem like a hefty expense, with a proper tax strategy, it can also be one of the best ways to save money. Knowing which tax credits your small business can claim could be a game-changer.

Ranked one of the Top Austin CPAs in Inc. 5000 Southwest List for 4th Year in a Row!

Companies on the 2024 Inc. 5000 Regionals: Southwest list had an average growth rate above 135 percent. Inc. magazine today revealed that Insogna CPA is ranked on its fourth annual Inc. 5000 Regionals: Southwest list.

How to Calculate Crypto Income Tax: 2024 IRS Rules

Did you sell or exchange any cryptocurrency during 2023? If so, you must disclose this information when you file your personal taxes this year, and you must pay cryptocurrency taxes.

Home Office Tax Deduction : Work from home FAQs, Rules, and more!

The home office deduction allows qualified taxpayers to deduct certain home expenses when they file taxes. To claim the home office deduction in 2024, you generally must exclusively and regularly use part of your home or a separate structure on your property as your primary place of business.

Amend Tax Return: Do I need to file one?

The most recent data from the IRS on individual tax returns indicates that out of 131 million returns filed, about 5 million were expected to be amended. This comes to less than 4 percent, but that projection still affects a significant number of taxpayers.

Top eCommerce Challenges in 2024 and How to Overcome them

How can you keep up with your eCommerce accounting when you also have partners to meet, logistics to manage, and a business to run? It’s impossible to do it all yourself. And, you’re not alone.

Do I need to update my ITIN number?

An Individual Taxpayer Identification Number (ITIN) is a nine-digit number issued by the IRS for individuals who need a U.S. taxpayer identification number but are not eligible for a Social Security number (SSN). If you don’t renew your ITIN on time this year (2024), it could delay your tax return.

What is an S Corporation, C Corp, and LLC: What they are and why they matter in 2024?

There’s a lot of buzz around the S Corporation Election and its implications for businesses. Let’s clear the air and help you make informed decisions.

Top eCommerce Accountant for Online Sellers & e-Commerce Companies

Feeling overwhelmed? We specialize in helping eCommerce and online sellers drive profitable results by taking the bookkeeping headache away.

2024 Startup Questions Every Entrepreneur Should Answer

If you’re thinking about becoming an entrepreneur, you might have more questions swirling around in your mind right now than you can count.

401K vs. IRA: Benefits and Differences for Smart Retirement Planning in 2024

As an individual and a business owner, the choices you make today will significantly impact your future, the future of your employees, and the future of your business. This is especially true when planning for retirement and making decisions about benefits.

Why is loan documentation for business loans important?

In the world of business in 2024, transactions can get complicated, and it’s essential to keep everything above board to avoid trouble with the IRS.

What are the phases of an eCommerce Business? Stage 2 : Profits $100,000 – $500,000

By now, your eCommerce business is likely no longer a side hustle but instead has become a part- or full-time job. And with an increase in sales comes an increase in responsibilities – as well as complexities.

Reasonable Compensation and S Corps in 2024

Unlike a C corporation, which pays taxes on its income, an S corporation distributes its income, losses, deductions, and credits to shareholders’ individual tax returns on a pro-rata basis.

What are the phases of an eCommerce Business? Stage 3: Profits $ 500,000 – $ 1 million (Part 1)

At this phase in your business growth, take a moment to pause and congratulate yourself. But that’s exactly why it’s crucial to stop and recognize how much hard work you’ve invested in building this company from the ground up.

Guide to S Corp taxes for Small Business Owners: S Corporation FAQs and Tips

While we see a number of questions related to S Corp tax saving strategies, the top question we get from small business owners regarding taxes is: “Am I paying too much in taxes?

What are the phases of an eCommerce Business? Stage 3: Profits $ 500,000 – $ 1 million (Part 2)

This is where you present your current financial state, which helps with securing funding (if needed) and getting that commercial space you’ve had your eye on — because your house simply cannot handle another delivery.

How to reduce S-Corp Tax as an S Corporation Shareholder in 2024

As an S Corporation, one of the best ways to minimize taxes is by compensating shareholders fairly. This article reviews setting appropriate compensation levels for your S Corp in 2024.

What are the phases of an eCommerce Business? Stage 4: Profits $ 1 million+ (Part 1)

You’re not just running a business; you’re managing an enterprise. With multiple channels in play and a growing team, your processes must communicate seamlessly to drive strategic decisions.

What to do after you get your LLC or INC?

Congratulations on setting up your new LLC or Incorporation (Inc.)! Now that your business entity is officially active, it’s time to take a few crucial steps to ensure everything runs smoothly and efficiently.

What are the phases of an eCommerce Business? Stage 4: Profits $ 1 million+ (Part 2)

Expanding into the global marketplace? You’re not alone. Many eCommerce businesses are diving into omnichannel marketing, content personalization, and automation.

10 Common Mistakes to Avoid when Starting a New Business: For Small Business Owners in 2024

The process of starting a small business can be an arduous one; there are numerous steps that need to be taken — and often in a precise order — to legally establish a business. As a result, the process can be overwhelming. Unfortunately, it’s also easy to overlook some important details and steps along the way.

What are the phases of an eCommerce Business? Stage 1: Profits Under $100,000 (Part 1)

Whether you’re just thinking about selling online, have started dipping your toes into online selling, or your business is taking off after your first “big” month with profits trending over $30,000 this year, this is the start of your hard work and investment into building your business to reach your goals.

12 Common Tax Problems to Avoid in 2024

Here are the top 12 tax issues, broken down into categories for business owners and individual taxpayers, and how everyone can minimize their impact this year.

What are the phases of an eCommerce Business? Stage 1: Profits Under $100,000 (Part 2)

But let’s be honest—how many people actually create these business plans before starting a business? In our experience, very few. The most important thing is keeping an updated cash-flow forecast.

Automated Bookkeeping for eCommerce and Online Sellers

We take your accounting worries away by creating monthly Balance Sheets and Profit & Loss statements that are easy to interpret and analyze over time.

Carried Interests Undergo Significant Tax Treatments in 2024

Carried interests, partnership interests held in connection with services performed, will experience significant changes in reporting and taxation treatment this year.

Where’s my Refund? How to Check Your Federal Tax Refund Status in 2024

Whether you chose direct deposit into one account, split your refund among several accounts, or asked the IRS to mail you a check, this tool provides online access to your refund information nearly 24/7.

E-Commerce and Amazon Accounting for Amazon FBA Sellers

Selling on Amazon is like getting lost in a digital jungle among thousands of other sellers. Amazon’s services don’t cover your store’s day-to-day financials and accounting, leaving you to fend for yourself in the wild.

Latest IRS Update: Navigating New 1099-K Reporting Rules for Business Owners

Today we’re breaking down some crucial IRS updates in a way that doesn’t make your eyes glaze over. So, let’s dive into the world of IRS Form 1099-K.

Are elder care or caregiver expenses tax deductible?

Because people are living longer now than ever before, many individuals are serving as caregivers for loved ones (such as parents or spouses) who cannot live independently.

The Essential Role of an Ecommerce Accountant for E-Commerce Business Owners

An eCommerce business has the potential to make an individual extremely wealthy while also allowing them to start a company from the comfort of home with very little capital.

EV Tax Credits: Things Electric Vehicle Owner Should Know in 2024

The Inflation Reduction Act (IRA) contains funding for energy programs, including a $7,500 tax credit for electric vehicles (EVs). The law also provides tax credits for commercial trucks and home charging installations in rural areas. Plus, some used electric vehicles are also eligible for an incentive.

How E-Commerce Sellers Benefit from Accountants

No matter the phase of your eCommerce business in 2024, we identify the ongoing CPA resources needed to be accounting efficient and minimize your taxes as much as legally possible.

How to Increase Business Cash Flow with Tax Planning

Regardless of how well your business is doing, the tax levied on your revenue probably feels like an extra expense, and it’s often treated this way. Properly managed, however, your tax responsibilities can be turned into an opportunity for growth and stability.

How Virtual CFO Services Can Help Your Business To Grow in 2024

You’re onto something big – a seasoned CFO who guides your financial moves to scale your business. But let’s face it, not every business has full-time CFO money to throw around. Enter our virtual CFO services – the ultimate fix.

Avoiding Tax Audit Nightmares: The Importance of Keeping a Mileage Log

I’ve got some real talk for you about that car of yours. No, not about the latest car wax or sweet rims—today, we’re diving into the world of taxes. That’s right, taxes. Don’t snooze on me now; this is important!

2024 Corporate Transparency Act Reporting Requirements

The Financial Crimes Enforcement Network (FinCEN) has recently issued a rule under the Corporate Transparency Act that’s going to change how you report beneficial ownership information.

Elevate Your Business Game with Reach Reporting!

Who doesn’t love a good status upgrade, right? We’re thrilled to announce our new “Preferred Partner” level with our integrated accounting partner, Reach Reporting. Now, let’s dive into the good stuff.

What Is A Virtual Controller? Why Your Business Needs One in 2024

As a business owner, your finances should be at the top of your priority list. However, with all the other responsibilities you have taken on with your growing business, it can be difficult to give your existing practices and financial systems the attention they need for your company to truly thrive.

How Long Should You Hold On To Old Tax Records?

Generally, taxpayers should hold on to their tax records for at least three years after the due date of the return to which those records apply.

Virtual CFO Services for Your Business

Anyone can call themselves a “virtual CFO” without ever being a CPA or formally trained in Accounting. Non-licensed individuals have no regulation, professional liability, or obligation to protect your data.

Employee Bonuses: The Tax Implications of Paying Bonuses to Employees in 2024

Instead of adding it to your ordinary income and taxing it at your top marginal tax rate, the IRS considers bonuses to be “supplemental wages” and levies a flat 22 percent federal withholding rate, unless your employer pays bonuses alongside regular wages.

Top 50 Cloud Accountants Award

With our tech stack of 20 different technologies, we provide up-to-date financial and reporting information quickly so business owners can act and make real-time decisions.

Why Should Small Business Owners Consider PEO in 2024

Whether you’re a business owner, high-level executive, or investor, you know that every cent counts. As you scale operations, your Human Resources (HR) needs will grow exponentially.

Why Switching to Cloud-Based Accounting Makes Good Business

Cloud accounting software is similar to traditional, on-premises accounting software, but it is hosted on remote servers, similar to the SaaS (Software as a Service) business model.

Why Hiring a Licensed CPA in 2024 is Crucial for Your Business

Below are just a few of the fraud-related news stories from recent years about unlicensed tax preparers committing fraud. From all over the country and all walks of life, these “tax preparers” knew what they were doing. Unfortunately, their clients did not.

Insogna CPA: Top Best Accountants in Austin

Our goal is to connect people with the best local experts. We scored Austin accountants on more than 25 variables across five categories and analyzed the results to give you a hand-picked list of the best.

Taxes on gambling winnings?

Gambling takes many forms, including casino games, horse racing, sportsbook betting, lotto tickets, scratchers, bingo, and more. For most, gambling is a fun, recreational activity.

Do I Need A CPA For My Business in 2024?

If you’ve been flying solo without the help of a Certified Public Accountant (CPA), you might be missing out on valuable tax deductions, business strategy insights, and profitability initiatives.

S Corporations: Operations and Filing Taxes

Business owners often wonder which business entity makes the most sense for their situation. An S Corporation (S Corp) is a popular choice because it offers both personal liability protection and certain tax benefits for corporate and personal income tax.

The Major Reasons a Virtual CFO Can Help Your Business

On a basic level, a virtual CFO (or vCFO for short) is exactly what it sounds like. This is someone who performs all the services normally associated with a chief financial officer, only in a third-party capacity.

10 Steps to Starting Your Business in 2024

Starting a new business is rarely a walk in the park. First-time entrepreneurs often underestimate the journey from a concept to a real-world business.

Inc. Magazine Award Winner in the Southwest Region

Insogna CPA is thrilled to announce its ranking on the prestigious Inc. 5000 Regionals Southwest list, marking our third consecutive year on this coveted list. This ranking reflects our ongoing commitment to excellence as a top CPA firm in Texas.

Combining a Vacation with a Foreign Business Trip? 2024 Guide in Maximizing Your Tax Deductions

When a self-employed individual embarks on a business trip outside the U.S., and the journey is entirely for business, all ordinary and necessary business travel expenses are deductible—just as if the trip were within the U.S.

What to Do If You Haven’t Filed Your Tax Return Yet

There are plenty of understandable reasons why you might not have filed your income taxes in 2024. Perhaps you’re new to the job market, and the requirement to file just slipped under your radar.

Hire the Best Accountant in Austin TX, 2024 Edition

To reach this level, every top accounting firm undergoes a thorough evaluation, including customer reviews, history, complaints, ratings, satisfaction, trust, cost, and overall excellence. When it comes to your financial health, you shouldn’t settle for anything less than the best.

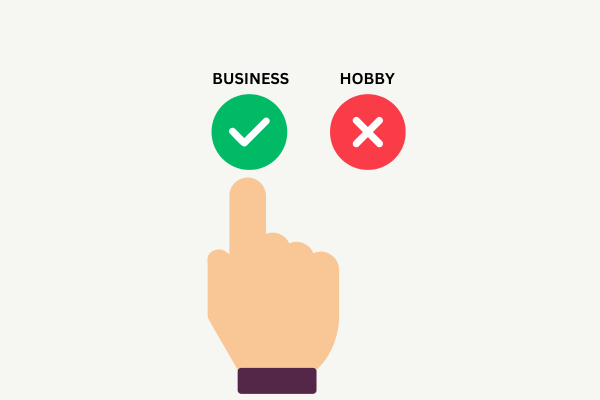

Hobby or Business? Understanding the Difference According to IRS Rules

When you’re passionate about something, it’s easy to lose track of time—and money—pursuing it. But if that passion starts bringing in cash, it’s time to ask yourself: Is this a hobby, or have I inadvertently become a business owner?

How to Deduct Meals and Entertainment in 2024: What Every Business Owner Needs to Know

In 2024, businesses can still deduct 50% of the cost of business-related meals. The temporary 100% deduction that applied in 2021 and 2022 is no longer available, so it’s back to the usual rules.

How to Create a Business Budget for Your Startup

As you piece together your budget, it’s not just about the numbers—it’s a chance to gain a deeper understanding of how your startup operates.

11 Business Tax Deductions in 2024

When tax season rolls around, every business owner starts looking for ways to minimize their tax bill and keep more of their hard-earned money. Knowing which business tax deductions you can claim is key to ensuring you’re not overpaying.

Tax Prep vs. Tax Planning

If you run a small business or are self-employed and pay taxes annually, you might be missing out on savings due to inefficient tax planning. Paying your tax bill all at once at the end of the year might seem straightforward, but it can lead to poor cash flow and those dreaded IRS penalties.

Do Olympians Pay Taxes on Their Medals? Tax Hacks for Winning Athletes

Hey there, athletes! It’s your friendly CPA team at Insogna CPA, here to share some smart tax tips tailored for your Olympic triumphs in 2024.

Why Traditional Accounting Still Matters in 2024: Beyond QuickBooks and TurboTax

Intuit promotes their products like QuickBooks and TurboTax as quick fixes for your tax needs. And sure, if you’re a seasoned pro, handling your own taxes might work out just fine.

Your 2024 Guide to IRS Form 8300: Cash Reporting Made Easy

Hey there, business owners! It’s your team at Insogna CPA, and we’ve got some must-know updates about IRS Form 8300 that might just save you a headache or two.

Offer in Compromise FAQs: Your Guide to Tax Relief

We’re all responsible for paying our fair share of taxes each year. But what happens when the amount you owe is simply out of reach?

How Can Accounting Firms Assist Startups & Small Business in 2024?

Accounting for small businesses can feel overwhelming, but with the right help, it doesn’t have to be. A certified public accounting (CPA) team can play a critical role in helping startups and small businesses through the dreaded tax season and beyond, making day-to-day operations smoother.

Social Security Breach: Is Your Financial Safety Net at Risk? Here’s How a CPA Can Shield You

In 2024, it seems like every other headline is about another breach, another hack, or another case of personal information being stolen. This time, it’s Social Security numbers that are in the crosshairs, leaving many wondering, “Am I next?”

What Is a Bottom Line in Accounting, and Why Does It Matter for my Business?

Do you know if the accounting method you’re using is the right one for your business? The difference between cash and accrual accounting lies in the timing of when sales and purchases are recorded.

How an S-Corp Can Reduce Your Taxes in 2024

Most businesses begin as a sole proprietorship because it’s easier to start and requires less paperwork and regulatory overhead. It generally costs less than filing as a Limited Liability Company (LLC) or Incorporation (INC).

How to Pay Taxes: A guide to making payments to the IRS for your Federal Tax

If you aren’t one of those lucky Americans who get a tax refund from the IRS, you might be wondering how to go about paying your balance due.

Understanding your Form 1099-K: How IRS 1099 Rules Impact Your 2024 Taxes

In recent years, the IRS has fine-tuned the rules surrounding Form 1099, and 2024 is no exception. If you’re handling non-employee compensation, you’ll need to stay updated.

Social Security Is Taxable? How to Minimize Taxes in 2024

How much (if any) of your Social Security benefits are taxable depends on several key factors. The following information will help you understand the taxability of your Social Security benefits.

Mid-Year Tax Checkup : Would it benefit you?

A mid-year tax check-up isn’t just for procrastinators—it’s for anyone who wants to make sure they’re not leaving money on the table. If you’re already starting to worry about taxes, don’t wait until the last minute.

We’re in the Spotlight: Insogna CPA Featured Partner of A2X

At Insogna CPA, we’re thrilled to share some exciting news: this month, we’re proudly featured as a partner in the A2X Directory.

Egg Donation & Taxes: What Egg Donors Need to Know in 2024

Egg donation is a generous act that can help families achieve their dreams of parenthood. However, if you’re considering becoming an egg donor, it’s important to understand the financial implications—especially when it comes to taxes.

What if I can’t pay my taxes?

It’s a common problem: You want to file your taxes on time, but you already know you’ll owe more than you can afford right now. So, you’re tempted to delay filing, thinking the IRS won’t come knocking until they have that latest tax return in hand.

What Is The Penalty For Not Filing Taxes? Penalties and More in 2024

We’ve all heard the saying about death and taxes, but it’s surprising how many people still skip filing their tax returns. If you’re one of them, thinking you can fly under the radar, it’s time to rethink that strategy.

Can You Pay Taxes with a Credit Card?

With tax season behind us, the next big worry is paying off those remaining tax bills. If you’re considering your options, paying your taxes with a credit card might have crossed your mind. It’s an alternative to IRS payment plans and could even offer some tempting rewards if your card has the right perks.

2024 Travel Nurse Tax Tips

Taxes—no one loves ’em, but everyone has to deal with ’em. But don’t worry, we’re here to guide you through the maze of tax deductions and savings your tax accountant should be working on for you.

5 Common Mistakes Your Bookkeeper Can Make (and How to Fix Them)

As your small business probably knows, anyone can perform basic bookkeeping tasks. Categorizing synced transactions from the bank isn’t rocket science. But it’s not just about finding someone who can handle these responsibilities.

What JLo and Ben Affleck’s Divorce Teaches Us About Estate Planning and Taxes in 2024

In the spotlight or not, life changes, like an impending divorce, can flip your financial world upside down. Just ask JLo and Ben Affleck.

Filing Taxes After a Divorce in 2024: Navigating Alimony and Child Support Tax Rules

In the U.S., alimony—also known as spousal support—is considered taxable income for the recipient and a tax deduction for the payer.

Moving to Austin, Texas? The Tax Tips You Need to Know

If you’re eyeing Austin, Texas, as your next home—whether for retirement, a job relocation, or just a change in scenery—here’s the lowdown on what to expect tax-wise in 2024.

Is the inheritance I received taxable?

This is a common question that often comes with confusion. When someone passes away, their assets may be subject to an inheritance tax before anything is passed on to the beneficiaries.

Tax Credits for Electric Vehicles in 2024

As electric vehicles (EVs) become more common in the business world, we receive plenty of questions about how the Commercial Electric Vehicle Federal Tax Credit works. Here are some of the most frequent queries you might be pondering.

2024 Child Tax Credit FAQs

If you received the Child Tax Credit or monthly payments in 2021, you might still have questions about how it affects your current tax situation. As we move into 2024, it’s important to stay informed about how these credits play a role in your IRS filings.

How to Pay Yourself as a Business Owner?

As a business owner, how much should I pay myself on a W2 before year end? How you pay yourself as a business owner largely depends on your business structure, where you are in your business journey, and a few other key factors.

Tax Tips for Procrastinators in Tax Filling

If you’ve been procrastinating on filing your tax return or have skipped past years, it’s time to think about the consequences. From penalties and interest to potential IRS enforcement actions, the costs of delaying can add up.

Does it make sense to buy this equipment before year-end?

If you’re eyeing a significant deduction (and who isn’t?), the Section 179 IRS tax code allows businesses to deduct up to $1,080,000 on qualifying capital equipment.

Read This before Tossing Old Tax Records!

If you’re the tidy type and have just filed your tax return for this year, 2024, you might be eyeing that stack of old tax records and wondering if it’s time to declutter.

How Inflation Can Impact Your Taxes in 2024

Guess what? Inflation isn’t just about rising prices—it’s also giving your federal tax breaks a bit of a boost. By the end of this, you’ll be walking around like a tax-saving pro.

Offer in Compromise FAQs

If you’re staring down a tax debt you can’t possibly pay, it’s time to consider an IRS Offer in Compromise (OIC). This option lets qualified individuals settle their tax debt for less than the full amount owed, offering a financial lifeline when times are tough.

6 Year-End Tax Planning Strategies to Consider Now

Have you kicked off your year-end tax planning yet? As we are approaching the final quarter, it’s the perfect time for strategic tax planning to reduce your tax bill. If you’re a business owner, tax planning isn’t a one-and-done deal—it’s an ongoing process.

Last Minute Tax Filing Tips 2024

Haven’t filed your taxes yet? It’s okay, you’re not alone. Believe it or not, many people don’t file in early February when tax season starts. In fact, about one-third of taxpayers in the U.S. wait until the last two weeks before the April deadline to file!

8 Smart Year-End Tax Planning Tips

Year-end is just around the corner, but you still have time to make some smart tax-saving moves before the clock runs out. These Power 8 strategies can help you lock in savings and set yourself up for a successful tax season.

10 Ways to Avoid Accounting Horror This Halloween

To keep the financial ghouls and gremlins out of your books this fiscal year, here’s your 2024 guide to preventing accounting nightmares.

File a Tax Extension in 2024: What You Really Need to Know

Sometimes life happens, and meeting that tax deadline isn’t feasible. A tax extension can give you up to six extra months to file your return, which is a relief when you need some breathing room.

Paralympics 2024: Proactive Tax Strategies for College and Pro Athletes

Hey, athletes! As you shine on the Paralympic stage, don’t let taxes steal the spotlight. With Name, Image, and Likeness (NIL) earnings rolling in, and your Olympic Medal monies piling up, understanding tax savings is your new game plan.

Tax Breaks for Parents in 2024: What You Need to Know

Many working parents need to arrange childcare for their kids under 13 (or any age if disabled) during the school break. One popular option that comes with a tax perk?

Rental income and expenses – Real estate tax tips

Many taxpayers, from short-term vacation hosts to long-term landlords, often wonder how to handle the income from renting their home or investment property.

Tax Benefits for Members of the Military in 2024

Military members benefit from a variety of special tax benefits. These include certain non-taxable allowances, non-taxable combat pay, and a variety of other special tax provisions designed to support those who serve.

Rental Property Tax Deductions for Landlords

Many of our clients own rental properties, whether as their main business or part of a diverse entrepreneurial portfolio. At Insogna CPA, we specialize in helping property owners maximize their rental property tax deductions and reduce tax burdens with strategies that work.

What triggers an audit by the IRS?

With tax season behind us, many are finding unexpected IRS notices in their mailboxes. While seeing the IRS letterhead can cause a spike in anxiety, the good news is that most of these notices are routine.

What Real Estate Investors Need to Know in 2024: Smart Moves for Your Property Investments

Real estate investing can enhance the risk-and-return profile of your portfolio, offering competitive returns. But let’s be honest—without proper guidance, navigating property investments can feel like you’re wandering in the dark. Don’t worry, though. We’ve got your back with some practical tips and insights to keep you on track in 2024.

For Rental Owners: What does the IRS consider a passive activity?

Rental activities typically fall under “passive” activities. This means rental losses can only be deducted against passive income, not nonpassive income like wages or investment earnings. If you’re unable to use rental losses in a given year, don’t worry—they carry forward indefinitely until your passive activities generate enough income to offset those losses.

2024 Tax Preparation Checklist: Documents To Gather Before Filing

Before you dive into preparing your income tax return, check out our updated 2024 Tax Preparation Checklist. Not every section will apply to you, so feel free to skip what doesn’t. By organizing your tax documents ahead of time, you’ll save yourself time (and stress) when it’s time to file.

Business partnerships: What is a partnership?

Navigating the complexities of business partnership taxes is crucial for every partnership entity. Staying compliant while optimizing your tax strategy can make a world of difference for your business’s bottom line.

Short-Term Rentals and Taxes Explained in 2024

In some situations, the rental income may be tax-free. In other situations, your rental income and expenses may need to be treated as a business, as opposed to a rental activity.

Made a Mistake on Your Tax Return. Now What?

Mistakes on tax returns are more common than you might think. Taxes can be tricky, and the paperwork? Well, it’s not winning any “simplified process” awards. If you’re filing taxes on your own, the chances of making a mistake can feel even higher. Read more >>

Top 4 Rental Property Questions Answered

Here are four key questions (and answers) to help you make smart, well-informed decisions about your rental properties, ensuring your real estate investment pays off.

Retirement accounts: Which is right for you?

Did you know one of the smartest ways to reduce your taxable income is by investing in your retirement? Retirement savings not only prepare you for the future but can also help you keep more of your hard-earned money today.

Is My Rental Property Considered a Business?

Several IRS factors determine whether you can claim your rental property as a Schedule C business or a Schedule E. The primary factor is whether you’re providing substantial services to your rental guests regularly.

2024 Tax Tips for IRA Owners

There are plenty of opportunities—and a few pitfalls—for individual retirement account (IRA) owners. While you don’t want to fall into a tax trap, you should definitely take advantage of these IRA tax tips and smart strategies available for 2024.

Partnership Compliance in 2024: What Your Business Must Know

One of the most important compliance requirements for partnerships is registering with the appropriate state agency. This involves filing a partnership agreement, which outlines the terms of the partnership, with the state.

How the New FTC Rule on Fake Reviews Affects Your Business

Have you been leaning on online reviews to boost your brand’s credibility? Well, buckle up—because the Federal Trade Commission (FTC) just dropped a new rule on fake reviews and testimonials, and if you’re not careful, you might find yourself in hot water.

You Do Not Want to Be On the Radar of the IRS

Hey there, fellow taxpayers! If you’re climbing the income ladder or managing foreign accounts, you might want to stick around for this one.

7 Must-Know Tax Tips for Global Entrepreneurs in 2024

You’re living your best life abroad, but there’s a nagging question in the back of your mind: Do I still have to deal with U.S. taxes?

Urgent: New Federal Filing Requirement for LLCs and Corporations – Act Before the December 31 Deadline!

If you’re a business owner with an LLC or corporation, we’ve got an important update for you. There’s a new federal requirement under the Corporate Transparency Act that means you need to file a Business Ownership Information (BOI) Report with FinCEN.

Can I Use My Roth IRA as an Emergency Fund?

Thinking about withdrawing your Roth IRA? Maybe it’s for a new home, unexpected expenses, or you’re just curious about accessing your retirement savings. The good news is, yes, you can withdraw money from your Roth IRA—but there are some important rules and timing to consider.

When Can a Taxpayer Deduct Disaster Losses?

A disaster loss is a tax-deductible loss that occurs in federally declared disaster areas—think floods, forest fires, or earthquakes. Much like a casualty loss, it involves damage to property, but only if the President has declared the area a federal disaster zone.

Remote Work and Taxes: Do Remote Employees Create Income Tax Nexus in 2024?

Remote work has become the new normal, but it’s not without its tax implications. As companies navigate the post-pandemic landscape, one important question remains: does remote working create income tax nexus for your business?

Reasons You Might Not Get a Tax Refund Next Year

With all the tax reform changes and reduced income tax withholding for most taxpayers, there’s growing concern that while more take-home pay is great now, it could mean an unpleasant surprise at tax time next year.

Texas Tax Help: Top Year-End Tax Tips

We get it. Taxes can feel like one big puzzle — especially if you’re running a growing business or navigating investments. Our award-winning tax pros take the guesswork out of it.

Gift Tax Explained: What It Is and How It Works

In 2024, the annual gift tax exemption remains $17,000, allowing individuals to gift up to $17,000 to as many people as they wish—without owing taxes on those gifts.

Record-Breaking Revenues: Celebrating Success Previous and Looking Ahead

At Insogna CPA, we believe that success is more than just numbers—it’s about helping businesses thrive and reach new heights. In the past, we had the privilege of doing just that.

3 ways to defer capital gains tax in 2024

When you sell a business or investment property for a profit, that’s a capital gain. Normally, you’re hit with taxes on that gain the year it happens, even though the value may have built up over many years.

What Is an EIN and Does Your Business Need One?

Entrepreneurs often shrug off the idea of getting an Employer Identification Number (EIN), thinking their small business doesn’t really need one.

What Is The Difference Between A Lien And A Levy?

If you’re reading this, there’s a good chance you’ve received one of those dreaded notices from the IRS. Interaction with the Internal Revenue Service is pretty common—especially during tax season.

No Hidden CPA Fees: Financial Transparency for 2024

Say goodbye to surprise bills and hidden charges! At Insogna CPA, we’re all about clear, upfront pricing—because your financial peace of mind shouldn’t come with a question mark.

How to Leverage Roth 401(k) and Roth IRA Plans for Retirement Success

Contributing to a Roth 401(k) or Roth IRA is a smart move for your retirement game plan. These accounts let you save while enjoying significant, long-term tax perks.

A Government Shutdown Isn’t Going to Save You from an IRS Audit

Yes, it’s true that we’ve come through some of the longest government shutdowns in U.S. history, and it may take government agencies – including the Internal Revenue Service – some time to catch up.

Find Licensed CPA Firm Near Me

Managing your finances, especially during tax season, is no small task—it’s a job that demands expert guidance. At Insogna CPA, we get it. We’re here to help you navigate the financial maze with the accountability and expertise you deserve.

Don’t be a Victim: Avoid being Scammed Online!

Tax season is just around the corner, and unfortunately, so are the scammers. These cybercrooks are out to steal your identity, drain your bank account, and maybe even file a tax return in your name.

Am I Eligible for a IRS Tax Penalty Abatement?

There are different types of IRS penalties that can be assessed against you. The most common ones include penalties for failing to file a tax return, filing late, or accuracy-related penalties for incorrectly reporting information on your return.

How to Choose the Right CPA for Your Business

The right Certified Public Accountant (CPA) can add immense value to your business, freeing up your time and growing your wealth. But here’s the kicker—not all CPAs are equipped to deliver that level of impact. So, the question is: Is your CPA truly meeting your needs in 2024?

What is Tax Basis and Why Is It So Important?

In reality, costs like purchase and sale fees are added to the basis, but the principle remains the same. Basis is key when calculating deductions for depreciation, casualties, and depletion, as well as when determining gains or losses on the sale of an asset.

Qualified Small Business Stock (QSBS): Definition and Tax Benefits

With so many promising companies still in the early stages of growth, qualified small business stock (QSBS) offers everyday investors a unique opportunity to back businesses they believe will become the next big thing.

Tax-Deferred: What Does It Mean And How Does It Benefit You

When you’re planning for your child’s future education or your own retirement, there are several smart ways to save. You might dive into the stock market, invest in income-generating real estate, or stash money in education savings accounts or retirement plans.

Paying for Assisted Living & Home Care for Senior Citizens in Texas

Did you know that nearly 12% of Texans are over the age of 65? With longer lifespans comes a reality many of us will face—caring for aging loved ones. While it’s a privilege to help, the costs of care can add up quickly, and understanding your options is crucial.

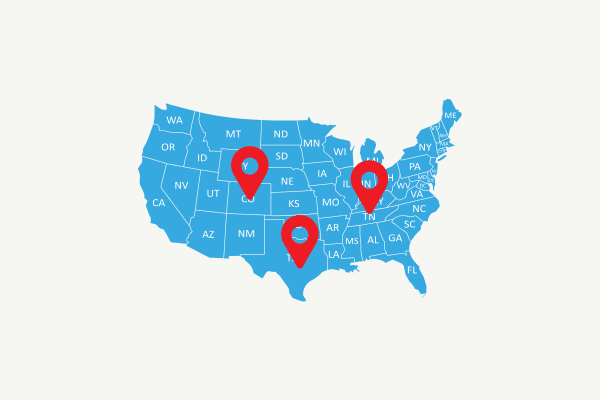

Approved to File Taxes in All 50 States: CPA across state lines

Mastering the nuances of filing taxes across multiple states can feel like trying to solve a puzzle without all the pieces. At Insogna CPA, our goal is to remove that stress and make sure your federal and state taxes are filed correctly—every single time.

Protect Yourself from Identity Theft

The internet has made life more convenient, but it’s also opened the door to scammers and cybercriminals worldwide. These digital crooks are always finding new ways to get their hands on your hard-earned money or steal your identity.

Record-Breaking Tax Refunds and Revenue Growth in 2024

The entire Insogna CPA team is excited to announce that we’ve hit a major milestone—helping our clients grow their revenues… We’re talking about smart tax strategies that helped businesses not only save but grow!

Mexico vs USA: How to Win at Cross-Border Business and Tax Compliance

Whether you’re a Mexican national investing in Texas or a Texas entrepreneur expanding into Mexico, navigating the tax rules, managing your business, and staying compliant can be tricky.

Puerto Rico’s Act 60: Is It the Right Tax Strategy for Your Business?

Tax strategies are a critical part of financial planning for entrepreneurs and high-income earners, and Puerto Rico’s Act 60 might just be the opportunity you’ve been searching for.

5 Proven Tax Strategies for High-Net-Worth Entrepreneurs to Save Big

Navigating the complexities of tax planning as a high-net-worth entrepreneur requires expertise, strategy, and a tailored approach. By leveraging the advanced tax-saving techniques, you can reduce liabilities and optimize your financial portfolio.

California vs. Texas: Which State Offers the Best Tax Benefits for Business Owners?

Choosing where to base your business can significantly impact your financial success. If you’re an entrepreneur managing a complex portfolio, the differences between California’s high-tax environment and Texas’s tax-friendly policies could mean the difference between thriving or just getting by.

The Hidden Costs of Tax Residency Changes: What Entrepreneurs Need to Know

Navigating the complexities of tax planning as a high-net-worth entrepreneur requires expertise, strategy, and a tailored approach. By leveraging the advanced tax-saving techniques, you can reduce liabilities and optimize your financial portfolio.

Maximizing Tax Savings with LLC Restructuring: A Guide for Business Owners

Choosing the right structure for your LLC can significantly impact your taxes, liabilities, and overall financial efficiency. For growing businesses, restructuring can be the key to unlocking tax savings and streamlining operations.

Consultant Tax Tips: Turning Active Income into Smart Savings

As a consultant, your expertise and time are valuable assets. But without the right tax strategies, a significant portion of your income can go toward taxes.

From Schedule C to S-Corp: When and Why to Make the Switch

Are self-employment taxes eating into your profits? If you’re running a growing business and filing taxes as a sole proprietor using Schedule C, you might be paying more than your fair share. While this approach works for newer or smaller businesses, it can quickly become inefficient as your revenue increases.

Capital Gains Planning: How to Protect Wealth from Big Tax Hits

When it comes to selling a stake in your business or managing long-term investments, capital gains taxes can take a significant bite out of your profits. If you’re not careful, these taxes can erode the wealth you’ve worked so hard to build.

How to Build a Tax-Efficient Business Structure for Entrepreneurs in the Wine Industry

Running a wine business is about more than producing exceptional bottles—it’s also about managing finances effectively. For wine entrepreneurs, building a tax-efficient business structure can protect your profits and set your business up for long-term success.

Strategic Tax Planning for High-Income Business Owners: Turning Complex Challenges into Opportunities

If you’re a high-income business owner, tax season often feels like an uphill battle. Between navigating intricate tax codes and juggling multiple responsibilities, it’s easy to end up paying more than your fair share. Even worse, without a clear strategy, you risk missing opportunities to grow your wealth and secure your financial future.

How to Prepare for Tax Season as a Self-Employed Professional

Are self-employment taxes eating into your profits? If you’re running a growing business and filing taxes as a sole proprietor using Schedule C, you might be paying more than your fair share. While this approach works for newer or smaller businesses, it can quickly become inefficient as your revenue increases.

Avoiding Penalties: Why Skipping Quarterly Payments Isn’t as Risky as You Think

Are self-employment taxes eating into your profits? If you’re running a growing business and filing taxes as a sole proprietor using Schedule C, you might be paying more than your fair share. While this approach works for newer or smaller businesses, it can quickly become inefficient as your revenue increases.

What to Expect: Partnering with a CPA for Your Self-Employment Journey

Self-employment offers exciting opportunities, but it also comes with unique financial challenges. From managing taxes to planning for long-term growth, the responsibilities can feel overwhelming.

Maximize Your Deductions: Top Tax-Saving Strategies for Home-Based Businesses

Are self-employment taxes eating into your profits? If you’re running a growing business and filing taxes as a sole proprietor using Schedule C, you might be paying more than your fair share. While this approach works for newer or smaller businesses, it can quickly become inefficient as your revenue increases.

Should You Hire a Contractor or Employee: A Guide for Small Business Owners

Self-employment offers exciting opportunities, but it also comes with unique financial challenges. From managing taxes to planning for long-term growth, the responsibilities can feel overwhelming.

Quarterly Taxes Simplified: A Guide for Freelancers and Business Owners

If you’re a freelancer or small business owner, managing quarterly taxes can feel overwhelming. Unlike employees with automatic tax withholdings, you’re responsible for estimating and paying your taxes independently. While it may seem daunting, the right tools and expert guidance from a trusted CPA in Austin, Texas, can make quarterly tax compliance simple and stress-free.

How to Optimize Your Retirement Savings as a Self-Employed Professional

Being self-employed comes with incredible freedom and flexibility, but it also means taking full

responsibility for your financial future—especially when it comes to retirement.

S-Corp vs. LLC: When to Make the Switch for Maximum Tax Savings

Choosing the right business structure is one of the most critical decisions small business owners make. Whether you’re just starting or experiencing significant growth, understanding the differences between LLCs and S-Corps is essential to maximizing your tax savings and aligning with your financial goals.

1099 Contractors: How to Reduce Your Tax Burden with Smart Business Structuring

Are taxes eating away at your 1099 income? As an independent contractor, you enjoy flexibility and control over your work—but these perks come with significant tax challenges. Unlike W-2 employees, you’re responsible for self-employment taxes, income taxes, and covering all business expenses.

Navigating Texas Tax Requirements for New Business Owners

Starting a business in Texas is an exciting opportunity, offering a pro-business environment, no state income tax, and a rapidly growing economy. However, understanding and meeting Texas tax and regulatory requirements is essential for long-term success.

Top Tax Planning Mistakes High-Income Earners Make—and How to Avoid Them

For high-income earners, managing wealth presents incredible opportunities—but also unique challenges. With higher earnings comes greater tax complexity, and without a clear strategy, it’s easy to lose money to missed deductions or avoidable penalties.

From W-2 to 1099: Essential Tax Tips for Your First Year of Self-Employment

Transitioning from a traditional job to self-employment is a rewarding step toward autonomy and financial growth. However, it also introduces a steep learning curve—especially when it comes to managing taxes. As a self-employed professional, you’re not only the boss but also your own payroll and tax manager.

Home Buying and Tax Planning: How to Balance Your Goals as a Business Owner

Owning a home is an exciting milestone, but for business owners, the journey can feel like a balancing act. You may be wondering how to save for a down payment while managing your tax obligations and keeping your business thriving.

Your 2024 Tax Strategy: Essential Steps for 1099 Earners Before Year-End

As 2024 approaches, independent contractors and freelancers have a limited window to finalize their year-end tax planning. Proactive tax strategies can save you thousands, help you avoid penalties, and set you up for success in the new year.

Maximizing Retirement Contributions as a Business Owner: What You Need to Know

As a business owner, planning for your retirement is just as critical as running your business. Unlike traditional employees who rely on company-sponsored plans, you have the unique opportunity to design a retirement strategy that fits your needs.

Your Trusted CPA Partner: Stepping Up for Fired Bench.co Customers

On December 27, 2024, Bench.co announced they are shutting down services effective immediately. This sudden closure leaves businesses using Bench.co without finalized 2024 financials—a critical requirement for preparing 2024 taxes.

How to Set Up a PLLC and Make the Most of Your 1099 Income

Are you struggling to make sense of your growing 1099 income? Managing taxes, protecting personal assets, and maximizing financial benefits can feel overwhelming, especially if you’re navigating it alone.

How to Untangle Personal and Business Finances: A Guide for Small Business Owners

Are your personal and business finances all mixed up? If so, you’re not alone. For many small business owners, managing finances feels like juggling too many plates.

From Chaos to Clarity: Fixing Historical Financial Discrepancies Without Risking an Audit

Running a business is demanding, and when things get busy, maintaining accurate financial records often falls by the wayside. Over time, these discrepancies can snowball into larger issues, affecting cash flow, decision-making, and tax compliance.

The Benefits of Moving from QuickBooks Desktop to QuickBooks Online for Modern Businesses

For many small and medium-sized business owners, managing finances feels like a constant balancing act. Tools like QuickBooks Desktop have been a reliable go-to for years, but as businesses grow, their limitations become more apparent.

Why Personal Tax Preparation is Just as Important as Business Tax Strategy

When you’re a business owner, it’s easy to focus solely on your company’s tax needs—maximizing deductions, managing cash flow, and ensuring compliance with tax laws. But ignoring personal tax preparation can lead to missed opportunities for holistic savings and long-term financial security.

Top 5 Mistakes Small Businesses Make When Managing Partner Distributions (and How to Fix Them)

Partner distributions are essential for maintaining fairness and financial transparency in small businesses. However, mismanaging these payouts can create conflict, cash flow issues, and attract IRS scrutiny.

How Quarterly Financial Reviews Can Save You Time and Money on Taxes

As a small business owner, tax season often feels overwhelming—like a storm of receipts, spreadsheets, and deadlines. What if you could avoid the last-minute stress, save money, and make smarter financial decisions year-round?

Top 5 Mistakes Small Businesses Make When Managing Partner Distributions (and How to Fix Them)

Partner distributions are essential for maintaining fairness and financial transparency in small businesses. However, mismanaging these payouts can create conflict, cash flow issues, and attract IRS scrutiny.

Why Personal Tax Preparation is Just as Important as Business Tax Strategy

When you’re a business owner, it’s easy to focus solely on your company’s tax needs—maximizing deductions, managing cash flow, and ensuring compliance with tax laws. But ignoring personal tax preparation can lead to missed opportunities for holistic savings and long-term financial security.

When to Reconcile vs. Move Forward: Solving Financial Challenges for Small Businesses

Struggling to get your financial records in order? Small business owners often face the daunting choice between reconciling historical financial data and starting fresh with a clean slate. This decision can feel overwhelming, especially if your books are disorganized or you’re falling behind on tax filings.

Streamline Your Multi-Entity Business: Accounting Tips for Rental Properties and Beyond

Struggling to keep your multi-entity business organized? Managing multiple entities, especially when rental properties are involved, can feel overwhelming. From tracking income and expenses to navigating inter-entity transactions, the complexities can pile up quickly.

Texas Rental Property Tax Strategies: Maximize Profits While Minimizing Hassle

If you own rental properties in Texas, the rewards can be significant, but so can the responsibilities—especially when it comes to taxes. From understanding depreciation rules to structuring LLCs, managing your rental property taxes effectively can help reduce stress and keep more money in your pocket.

Multi-State Property Owners: Simplifying Your Taxes with a Texas CPA

Feeling overwhelmed by the tax complexities of managing properties across multiple states? If you’re juggling properties in Texas and other states, you know how quickly tax season can turn into a headache. Each state has its own tax rules, income allocation requirements, and deadlines.

Flipping Success: Tax-Saving Tips for Texas House-Flipping Businesses

Struggling to get your financial records in order? Small business owners often face the daunting choice between reconciling historical financial data and starting fresh with a clean slate. This decision can feel overwhelming, especially if your books are disorganized or you’re falling behind on tax filings.

From Florida to Texas: Transitioning Your CPA Services for Local Expertise

Are you relocating your business from Florida to Texas and feeling overwhelmed by the financial and tax changes? Moving to a new state comes with exciting opportunities, but it also brings unique challenges—especially when it comes to understanding Texas-specific tax laws, business compliance, and financial setups.