the Future

Financial Infrastructure:

✅ Tech Stack & Financial System Integration

>We use QuickBooks Online as your core accounting hub, then evaluate, integrate, and optimize additional financial software tools to enhance reporting, automation, and overall efficiency. Our team continuously tests and implements the latest technology to ensure your systems scale with your business needs.

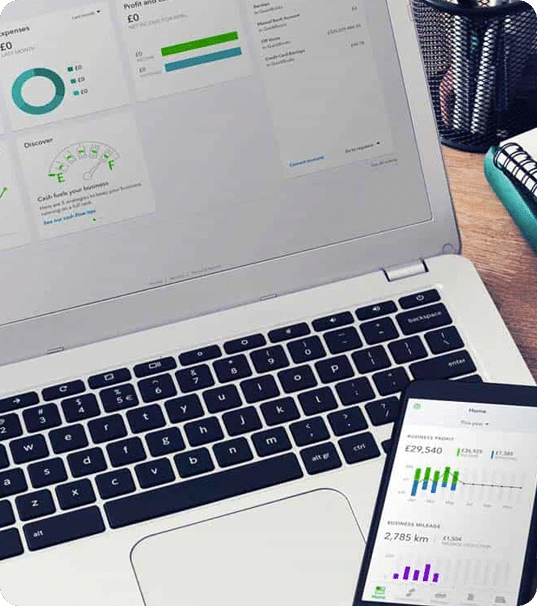

✅ Cash Flow Automation & Process Optimization

>Speed up accounts receivable collection and extend accounts payable timelines with automation tools that streamline approvals and reduce inefficiencies. These optimizations help you maintain stronger cash flow month after month.

✅ Scalable Accounting & Finance Teams

>As your business grows, so do your financial needs. That’s why we proactively hire, train, and expand our team ahead of demand—ensuring you always have the right financial expertise at every stage of growth. Whether you need additional support for M&A activity, multi-entity financials, or advanced tax planning, we have the capacity to scale with you.

✅ Mergers, Acquisitions & Due Diligence Support

>Ensure financial readiness for M&A activity, investor audits, and compliance requirements.

Do I need a full-time CFO, or is a Fractional CFO enough?

A full-time CFO is typically needed for companies preparing for public markets or significant capital raises. A Fractional CFO provides the same high-level financial strategy at a fraction of the cost—ideal for businesses under $50M in revenue that need expert financial leadership without a full-time executive salary.

How does a CFO integrate with my existing finance team?

We collaborate weekly, monthly or quarterly with your controller, bookkeepers, and finance team to provide executive-level financial strategy, tax planning, and high-level guidance. Our role is to complement your existing team—helping them refine financial processes, optimize cash flow, and align financial strategy with your business goals.

Can a CFO help secure financing or prepare for investors?

Yes! While we don’t directly provide financial modeling or pitch decks, we connect you with trusted third-party resources for these needs. As your licensed CPA firm, we assist in ensuring your financials are investor-ready, supporting due diligence, and structuring financial data to strengthen your position for debt or equity financing.

What industries benefit from CFO services?

We work with service-based businesses, SaaS companies, eCommerce brands, real estate firms, and multi-location businesses needing scalable financial infrastructure.

Do I need a full-time CFO, or is a Fractional CFO enough?

A full-time CFO is typically needed for companies preparing for public markets or significant capital raises. A Fractional CFO provides the same high-level financial strategy at a fraction of the cost—ideal for businesses under $50M in revenue that need expert financial leadership without a full-time executive salary.

How does a CFO integrate with my existing finance team?

We collaborate weekly, monthly or quarterly with your controller, bookkeepers, and finance team to provide executive-level financial strategy, tax planning, and high-level guidance. Our role is to complement your existing team—helping them refine financial processes, optimize cash flow, and align financial strategy with your business goals.

Can a CFO help secure financing or prepare for investors?

Yes! While we don’t directly provide financial modeling or pitch decks, we connect you with trusted third-party resources for these needs. As your licensed CPA firm, we assist in ensuring your financials are investor-ready, supporting due diligence, and structuring financial data to strengthen your position for debt or equity financing.

What industries benefit from CFO services?

We work with service-based businesses, SaaS companies, eCommerce brands, real estate firms, and multi-location businesses needing scalable financial infrastructure.