Tax Software vs. CPA:

Which Is Right for You?

Which Is Right for You?

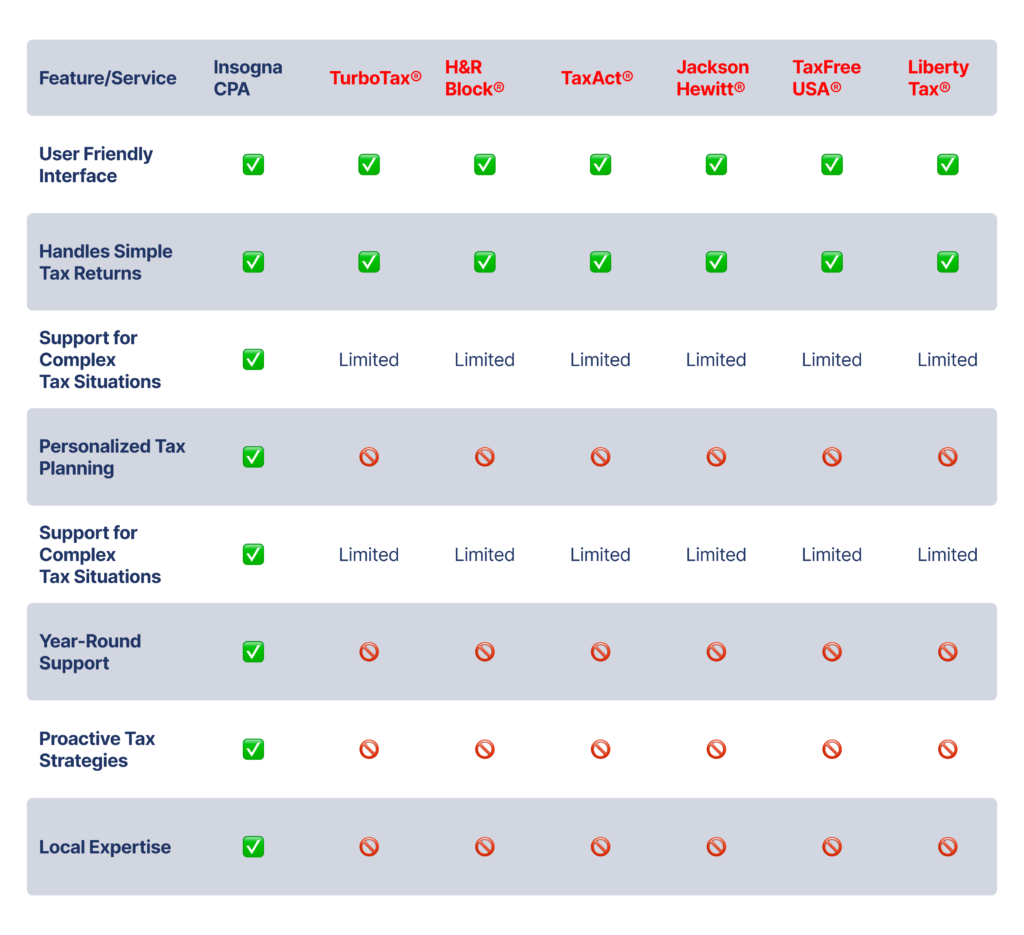

Choosing between tax software and a Certified Public Accountant (CPA) for your tax preparation is a crucial decision. While tax software offers a do-it-yourself approach, CPAs provide personalized guidance, especially for complex tax situations. Explore the benefits and limitations of each to determine the best fit for your needs.

Tax Software vs. CPA: Which Is Right for You?

Choosing between tax software and a Certified Public Accountant (CPA)

for your tax preparation is a crucial decision.

While tax software offers a do-it-yourself approach, CPAs provide personalized guidance, especially for complex tax situations. Explore the benefits and limitations of each to determine the best fit for your needs

While tax software offers a do-it-yourself approach, CPAs provide personalized guidance, especially for complex tax situations. Explore the benefits and limitations of each to determine the best fit for your needs

Choosing between tax software and a Certified Public Accountant (CPA)

for your tax preparation is a crucial decision.

While tax software offers a do-it-yourself approach, CPAs provide personalized guidance, especially for complex tax situations. Explore the benefits and limitations of each to determine the best fit for your needs

While tax software offers a do-it-yourself approach, CPAs provide personalized guidance, especially for complex tax situations. Explore the benefits and limitations of each to determine the best fit for your needs

The Truth About “Tax Experts” at Tax Software Companies

Platforms like TurboTax® Live and H&R Block® Online may advertise access to a “tax expert”—but here’s what they don’t tell you.

Most online tax software “experts” are not Certified Public Accountants or Enrolled Agents. Many are trained for just a few weeks and follow software scripts—there’s no licensing, no long-term accountability, and no personal incentive to optimize your outcome

Why Tax Software May Not Be Enough for Complex Tax Needs

Tax software like TurboTax® and H&R Block® can work well for simple returns with just a W2 and mortgage but when it comes to 1099 income, rental property deductions, stock option reporting, household employees, foreign FBAR reporting, or 1031-exchanges, they often fall short.

These tools are built for compliance, not strategy which means they skip over legal gray areas that could save you thousands. That’s where an experienced CPA team makes the difference—by asking the right questions and helping you legally maximize every deduction.

These tools are built for compliance, not strategy which means they skip over legal gray areas that could save you thousands. That’s where an experienced CPA team makes the difference—by asking the right questions and helping you legally maximize every deduction.

The Truth About “Tax Experts” at Tax Software Companies

Platforms like TurboTax® Live and H&R Block® Online may advertise access to a “tax expert”—but here’s what they don’t tell you.

Most online tax software “experts” are not Certified Public Accountants or Enrolled Agents. Many are trained for just a few weeks and follow software scripts—there’s no licensing, no long-term accountability, and no personal incentive to optimize your outcome

Most Self-Employed Business Owners Overpay in Taxes—Are You?

Tax software like TurboTax® and H&R Block® can work well for simple returns with just a W2 and mortgage but when it comes to 1099 income, rental property deductions, stock option reporting, household employees, foreign FBAR reporting, or 1031-exchanges, they often fall short.

These tools are built for compliance, not strategy which means they skip over legal gray areas that could save you thousands. That’s where an experienced CPA team makes the difference—by asking the right questions and helping you legally maximize every deduction.

These tools are built for compliance, not strategy which means they skip over legal gray areas that could save you thousands. That’s where an experienced CPA team makes the difference—by asking the right questions and helping you legally maximize every deduction.

Working with a Certified Public Accountant (CPA) offers significant advantages—especially if your return involves complexity. CPAs deliver personalized tax strategies, stay ahead of changing tax laws, and can represent you if the IRS comes calling.

But more importantly, our proactive approach is designed to avoid audit triggers in the first place—so your return is not just optimized, but defensible."

But more importantly, our proactive approach is designed to avoid audit triggers in the first place—so your return is not just optimized, but defensible."

Expertise in Complex Tax Matters

CPAs are equipped to handle intricate tax scenarios, ensuring accuracy and compliance.

Personalized Tax Strategies

Our experienced tax team customizes every return with a proactive plan to maximize all eligible deductions and credits—based on your unique

situation.

Year-Round Support

Unlike seasonal tax software, CPAs provide continuous assistance and planning.

Comprehensive Audit Representation

In case of an audit, a CPA can represent and defend your tax filings.

Our first year using Insogna CPA. They did an outstanding job. They were responsive, understanding, and proactive. Chase and his team have been very supportive, especially at this time, and helped us with our business transitions. They respond quickly and professionally. They assisted us with critical decisions and planning, working on our accounting, tax and payroll needs..

Update 2/28/2023

After several years now, Insogna CPA is consistently providing us with outstanding service for both business and person taxes and accounting.

The Insogna team has not only met but exceeded my expectations in every way possible. From the initial consultation to the final delivery of services, their professionalism, expertise, and dedication truly stood out.

The Insogna team representatives not only met my expectations but continually exceeded them in every way. I would highly recommend your services to anyone in need of expert financial guidance and support. Insognas dedication to client satisfaction and exceptional level of service make them a valuable asset to any team.

I am a small business owner and have been overwhelmed with doing my own books and dealing with non communicative and untimely accountants. I have found Chase and have been very happy with his services. His tax returns are timely, he is fast to respond to your emails even outside of regular working hours.

Just the other day he saw some trends in my business and asked to meet with me without my prompt. He dedicated an entire hour and gave us pertinent and actionable advice to make our business more efficient and profitable.

If you are looking for a professional, timely and serious CPA look no more!

Ready to Maximize

Your Tax Benefits?

Don’t leave your tax outcome to a generic algorithm.

Whether you’re dealing with 1099 income, rental properties, stock options, or just want to avoid missing deductions—our licensed CPA team delivers personalized tax strategies, year-round guidance, and audit support no tax software can match.