Featured Pages

Business Owners: 5 Reasons Why a Licensed CPA is Your Secret Weapon

Running your own business is a lot. You’re the boss, calling the shots and chasing your dreams. That’s where a licensed CPA steps in as your secret weapon.

The 2024 Guide to Sales Tax for Online Sellers: What Every Business Needs to Know

Sales tax is not a straightforward subject; in fact, it has a lot of moving parts. When it comes to sales tax for online sellers, things can get even more complicated.

How to Avoid a Tax Audit for Small Business Owners

Small business bookkeeping can be challenging and full of obstacles, but you can increase your chances of avoiding an IRS tax audit by understanding what accounting mistakes generally trigger suspicion and how to avoid them

What is the NEW FinCEN’s Reporting Rule: Things Your LLC/INC Needs to Know

Starting January 1, 2024, FinCEN’s Beneficial Ownership Information Reporting Rule comes into effect. This rule ensures transparency in business ownership by requiring companies to report key information to the U.S. Government.

Beyond Automated Bookkeeping: How to get the most of your CPA Accountant

The rise of automation has been a game-changer for many businesses, enabling them to cut costs and streamline operations in 2024. Have you ever considered why your small business needs more than just automated bookkeeping?

2024 Legal Tax Tips: 5 Ways to Reduce Your Tax Bill

Taxes can be stressful, and it may be tempting to procrastinate—don’t give in to that temptation. By thinking ahead and working with an expert, you can turn the hassle of doing your taxes into an opportunity to keep some of your hard-earned income in your pocket where it belongs.

Discover 5 Tax Credits Every Small Business Owner Can Claim in 2024

Running a business comes with many financial responsibilities, and paying taxes is a significant one. While it might seem like a hefty expense, with a proper tax strategy, it can also be one of the best ways to save money. Knowing which tax credits your small business can claim could be a game-changer.

How to Calculate Crypto Income Tax: 2024 IRS Rules

Did you sell or exchange any cryptocurrency during 2023? If so, you must disclose this information when you file your personal taxes this year, and you must pay cryptocurrency taxes.

What is an S Corporation, C Corp, and LLC: What they are and why they matter in 2024?

There’s a lot of buzz around the S Corporation Election and its implications for businesses. Let’s clear the air and help you make informed decisions.

2024 Startup Questions Every Entrepreneur Should Answer

If you’re thinking about becoming an entrepreneur, you might have more questions swirling around in your mind right now than you can count.

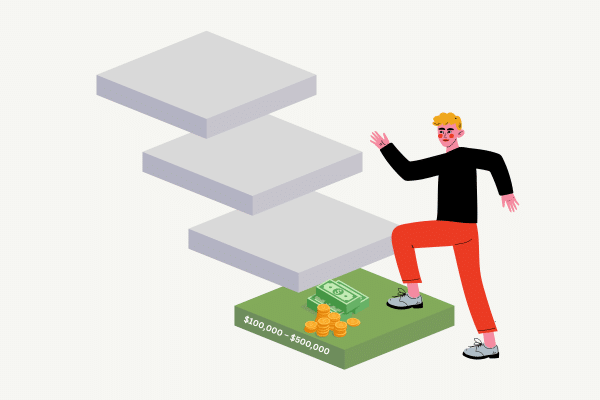

What are the phases of an eCommerce Business? Stage 2 : Profits $100,000 – $500,000

By now, your eCommerce business is likely no longer a side hustle but instead has become a part- or full-time job. And with an increase in sales comes an increase in responsibilities – as well as complexities.

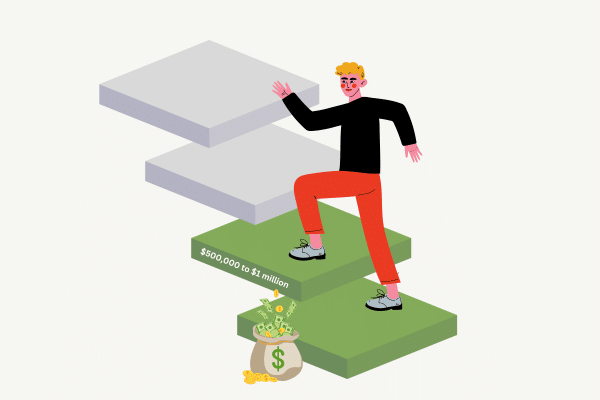

What are the phases of an eCommerce Business? Stage 3: Profits $ 500,000 – $ 1 million (Part 1)

At this phase in your business growth, take a moment to pause and congratulate yourself. But that’s exactly why it’s crucial to stop and recognize how much hard work you’ve invested in building this company from the ground up.

What are the phases of an eCommerce Business? Stage 3: Profits $ 500,000 – $ 1 million (Part 2)

This is where you present your current financial state, which helps with securing funding (if needed) and getting that commercial space you’ve had your eye on — because your house simply cannot handle another delivery.

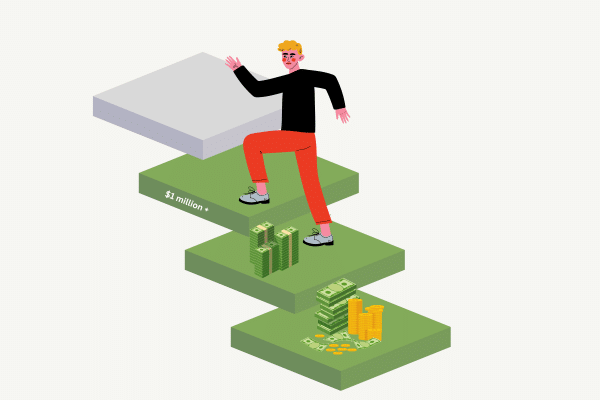

What are the phases of an eCommerce Business? Stage 3: Profits $ 1 million+ (Part 2)

Expanding into the global marketplace? You’re not alone. Many eCommerce businesses are diving into omnichannel marketing, content personalization, and automation.

10 Common Mistakes to Avoid when Starting a New Business: For Small Business Owners in 2024

The process of starting a small business can be an arduous one; there are numerous steps that need to be taken — and often in a precise order — to legally establish a business. As a result, the process can be overwhelming. Unfortunately, it’s also easy to overlook some important details and steps along the way.

Automated Bookkeeping for eCommerce and Online Sellers

We take your accounting worries away by creating monthly Balance Sheets and Profit & Loss statements that are easy to interpret and analyze over time.

E-Commerce and Amazon Accounting for Amazon FBA Sellers

Selling on Amazon is like getting lost in a digital jungle among thousands of other sellers. Amazon’s services don’t cover your store’s day-to-day financials and accounting, leaving you to fend for yourself in the wild.

Latest IRS Update: Navigating New 1099-K Reporting Rules for Business Owners

Today we’re breaking down some crucial IRS updates in a way that doesn’t make your eyes glaze over. So, let’s dive into the world of IRS Form 1099-K.

How E-Commerce Sellers Benefit from Accountants

No matter the phase of your eCommerce business in 2024, we identify the ongoing CPA resources needed to be accounting efficient and minimize your taxes as much as legally possible.

The Essential Role of an Ecommerce Accountant for E-Commerce Business Owners

An eCommerce business has the potential to make an individual extremely wealthy while also allowing them to start a company from the comfort of home with very little capital.

How Virtual CFO Services Can Help Your Business To Grow in 2024

You’re onto something big – a seasoned CFO who guides your financial moves to scale your business. But let’s face it, not every business has full-time CFO money to throw around. Enter our virtual CFO services – the ultimate fix.

Avoiding Tax Audit Nightmares: The Importance of Keeping a Mileage Log

I’ve got some real talk for you about that car of yours. No, not about the latest car wax or sweet rims—today, we’re diving into the world of taxes. That’s right, taxes. Don’t snooze on me now; this is important!

Elevate Your Business Game with Reach Reporting!

Who doesn’t love a good status upgrade, right? We’re thrilled to announce our new “Preferred Partner” level with our integrated accounting partner, Reach Reporting. Now, let’s dive into the good stuff.

2024 Corporate Transparency Act Reporting Requirements

The Financial Crimes Enforcement Network (FinCEN) has recently issued a rule under the Corporate Transparency Act that’s going to change how you report beneficial ownership information.

Why Should Small Business Owners Consider PEO in 2024

Whether you’re a business owner, high-level executive, or investor, you know that every cent counts. As you scale operations, your Human Resources (HR) needs will grow exponentially.

Why Hiring a Licensed CPA in 2024 is Crucial for Your Business

Below are just a few of the fraud-related news stories from recent years about unlicensed tax preparers committing fraud. From all over the country and all walks of life, these “tax preparers” knew what they were doing. Unfortunately, their clients did not.

The Major Reasons a Virtual CFO Can Help Your Business

On a basic level, a virtual CFO (or vCFO for short) is exactly what it sounds like. This is someone who performs all the services normally associated with a chief financial officer, only in a third-party capacity.

Why Should Small Business Owners Consider PEO in 2024

Whether you’re a business owner, high-level executive, or investor, you know that every cent counts. As you scale operations, your Human Resources (HR) needs will grow exponentially.

10 Steps to Starting Your Business in 2024

Starting a new business is rarely a walk in the park. First-time entrepreneurs often underestimate the journey from a concept to a real-world business.

How to Deduct Meals and Entertainment in 2024: What Every Business Owner Needs to Know

In 2024, businesses can still deduct 50% of the cost of business-related meals. The temporary 100% deduction that applied in 2021 and 2022 is no longer available, so it’s back to the usual rules.

How to Create a Business Budget for Your Startup

As you piece together your budget, it’s not just about the numbers—it’s a chance to gain a deeper understanding of how your startup operates.

How Can Accounting Firms Assist Startups & Small Business in 2024?

Accounting for small businesses can feel overwhelming, but with the right help, it doesn’t have to be. A certified public accounting (CPA) team can play a critical role in helping startups and small businesses through the dreaded tax season and beyond, making day-to-day operations smoother.