Hiring the right CPA accounting firm to contribute to your team’s success as an eCommerce business owner is critical. It takes time, know-how and diligence to stay the course to find the right solution for you and your growing ecommerce or online retail business. Knowing what type of tax strategy plus putting a plan in place to implement it is an important step in securing the financial future of your business – and your own personal wealth. That’s why you’ve come to the right place – The E-commerce Business Owner’s Guide to Accounting, Tax, and Accumulating Wealth. Our guide will get you on the right track for finding accounting systems, tax planning, and wealth management to take your ecommerce business to the next level.

Table of Contents

It’s important you find an accounting partner that understands your business and that has experience with your E-Commerce platform. Our professionals have experience with accounting for Amazon, Amazon Dropshipping, Shopify, and many other common eCommerce platforms.

Additional Resources

Ideally you want to have a CPA on your team from Day 1 to help manage your business and personal finances as your business grows. As your ecommerce business grows, your finances will get more complicated. Sales, returns, supplier payments, banking fees — all of the in-and-out money movements will need to be properly categorized, analyzed, and then reported to the tax authorities.

Without proper accounting systems in place, you can quickly get overwhelmed with all the financial data you are up against.

“Managing many Ecommerce businesses over the years, we tend to see four stages that owners go through, with each phase generally needing a specific set of CPA services,” says Chase Insogna, President of Insogna CPA.

As you are scaling your business, find out how an Ecommerce-focused CPA firm can help address your business and personal financial goals.

Read More in The Ecommerce Stages of Growth

If these apply to you read more at Ecommerce Business Stage – Profits Under $100,000

If this is you find out more about the accounting and tax support you need at Ecommerce Business Stage Profits $100,000 – $500,000

If this is you check out eCommerce Business Stages – Profits $500,000 to $1 million part 1 and eCommerce Business Stages – Profits $500,000 to $1 million part 2

If you’ve built your E-commerce business to >$1,000,000 in annual revenues you will definitely want to talk to an experienced CPA firm that can advise you on optimizing your accounting structure, minimizing taxes, and tax efficient strategies to help you accumulate wealth now.

A CPA advisor, like Insogna CPA, understands the complexities of running a successful e-commerce business, and that you need accurate data to make well-informed decisions. A CPA advisor will put real-time data and robust reporting at your fingertips to help you steer your business in the right direction. While you focus on growing your online customer base, Insogna CPA will ensure you’re on top of tax payments and filings, handle your payroll processing, and help with other complicated tasks that distract you from your core responsibilities.

By leaving the financial details to a professional CPA advisor, you’ll have more energy to spend on growing your e-commerce empire.

Growing your E-Commerce business is a complex task. It can be challenging to start and grow a business, whether it is a traditional one or an online eCommerce business. According to data from the Bureau of Labor Statistics, about 20% of small businesses fail in their first year, and about 50% fail by their fifth year. While these aren’t specific to eCommerce businesses, they indicate that you can’t just set up an online store and hope that customers will come clicking (or tapping) to your site. A CPA advisor can you help you to avoid the pitfalls that many small businesses fall into, and can specifically guide you in benchmarking your business to best practices for online stores and e-Commerce businesses.

Accounting lets you understand the health of your online or ecommerce business, plan for the future, and file your taxes correctly. Accounting is the big picture stuff: financial reports, taxes, planning for growth. Bookkeeping is the work of recording your transactions and keeping track of your money. These tasks together give you the financial information you need to make sound business decisions.

Here are the key topics you need to consider regarding accounting in your ecommerce business.

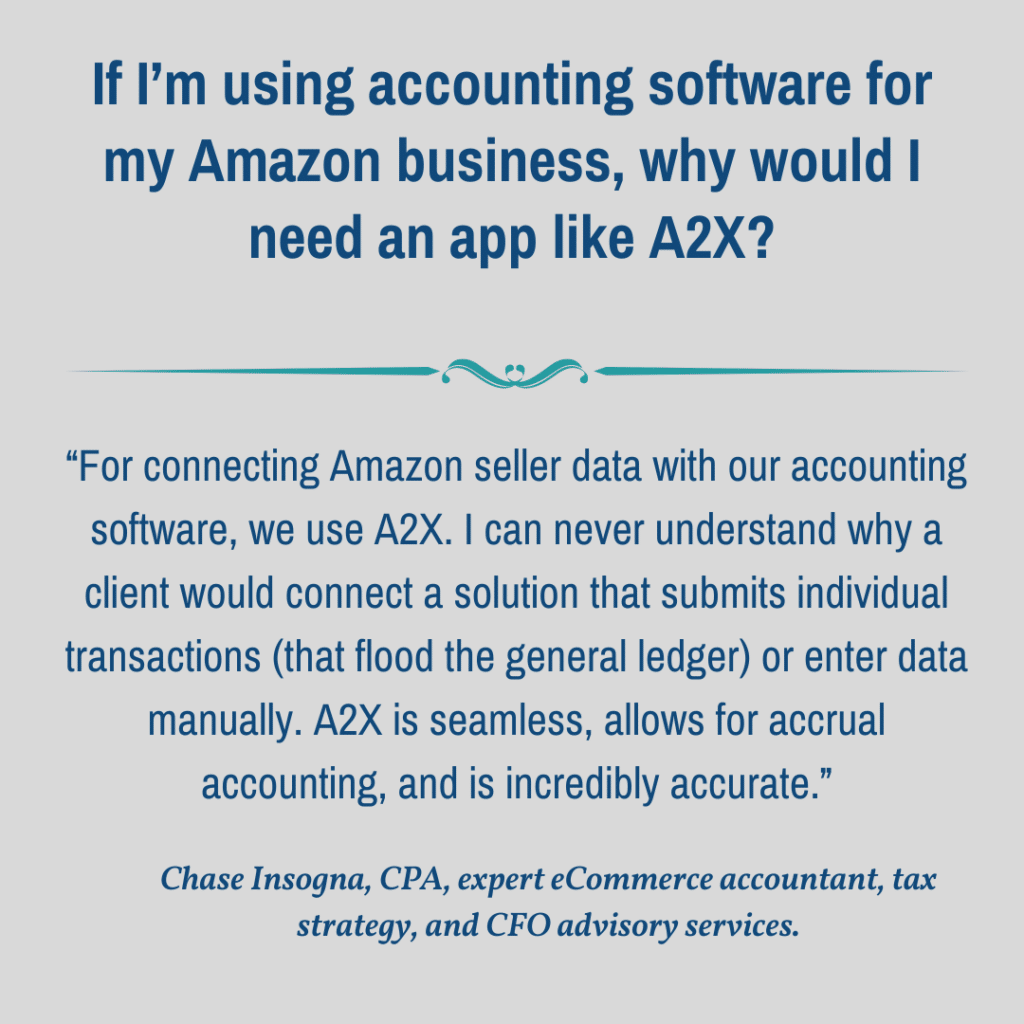

A key component in your E-Commerce Business is using the right cloud accounting software, such as Quickbooks Online. Cloud accounting software enables you to have your data and software accessible online at all times and from any device. In addition, unlike spreadsheets, they provide added reliability and accountability. They also allow you to connect to other best-in-class third-party apps. For example, you can sync it with inventory apps to measure your goods, quantity of goods, or cost of goods. Another benefit is around sales tax calculations. You can hook up QBO to TaxJar to understand your tax liabilities in each state.

Here’s a short checklist of things to consider when getting started with cloud accounting software.

Additional Resources

Navigating the U.S. and International tax system can be confusing for both new and veteran eCommerce sellers.

As an eCommerce business, you are required to comply with the tax jurisdictions in which your business operates.

In order to do this efficiently you need to choose a CPA advisor that understands the intricacies of tax compliance, and that can assist you in tax planning so that you both avoid penalties, and also keep the most in your pocket.

Building a comfortable future for yourself, your family and employees starts with a plan. Our year-round wealth management experts will analyze your tax structure, risk tolerances, estate considerations and financial goals to deliver a clear course of action you can take to protect your wealth.

While many accounting and bookkeepers can take care of your business, they don’t look at building the personal wealth of business owners or employees. Only Insogna CPA looks at you and your business holistically so that you can build your wealth while you grow your business.

Get started now on understanding how Building Wealth is a critical component of finding the right CPA firm for your Ecommerce or Online business.

Insogna CPA is an innovative team of informed experts providing an insightful understanding of your business with accounting advisory, financial coaching, and tax strategy delivered with a solutions-based approach.

© 2022 Insogna CPA PC. All rights reserved.