You’ve decided to take the leap and start an eCommerce business. Congrats!

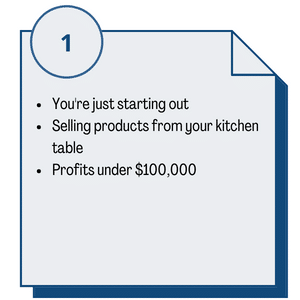

- You’re thinking about selling online.

- You’ve started dipping your toes into online selling.

- Your online selling business is taking off after your first “big” month and your profit is trending over \$30,000 this year.

This is the start of your hard work and investment into building this business to reach your goals. It’s time to nail down the big ideas, strategize over your growth targets, and develop a well, thought-out business plan. It’s time to clear out that storage shed or guest bedroom and begin accumulating stock. It’s time to take action so that you can live out your dream of building your own successful eCommerce business.

In the early days, you’ve probably done some homework and figured out what’s important: marketing your products, determining what capital to use to start, and getting those first sales in the door, especially during the fourth quarter. Achieving these three goals is usually crucial to kick-starting your success. You are likely doing all of your own sourcing, buying, pricing, and listing online, as well as managing fulfillment (or maybe utilizing a co-packer), customer service, inventory management, and sales taxes….and that is before you even think about completing all of the back-office tasks, such as accounting, inventory count and how to minimize your taxes.

Accounting 101

- Getting accounting set up from the beginning is crucial with your eCommerce business, because the more this step is delayed into Phase 2 (or worse, Phase 3), the more mountainous the amount of work required to clean this information up – as well as the significant cleanup costs that come with this project work. And have you considered how you’ll provide your lender with financial statements if you’re seeking financing or a mortgage?

- Accounting is not just syncing and categorizing your transactions. Are you properly recording gross revenues? Most merchants only sync net amounts to your books. If you value your time and would rather automate as much accounting work as possible, the costs easily outweigh focusing more of your attention on selling more of your products online. Maybe you manufacture or assemble your own products. What about recording COGS from inventory to match your revenues? Or maybe you’re reselling products by arbitraging? With all of the platform fees, do you have any easy way to determine true net profitability per product sold, with overhead included?

- Then there is your business’ structure to consider. Many start out as a DBA (Doing-Business-As) with their county registration. Just remember this does not protect your business name with your state, so if you are building a brand or storefront name, it is possible someone could register this too and easily compete against you – or worse, legally claim your brand name. And if you’re selling on Amazon and/or other platforms, changing your business name and EIN# can potentially cause you to lose all of your reviews, causing you to start from scratch again (from a marketing viewpoint). So, setting up an LLC is likely beneficial in most cases when starting out. We can help advise on the best structure for tax strategy planning so you can maximize your tax savings with your eCommerce business.

You may be selling through eBay, the Amazon Marketplace , Etsy, and/or perhaps your own website.

Your customers have mostly stumbled upon you or found you through word-of-mouth, and you wish you could focus more of your time and efforts on marketing and growing, instead of worrying about educating yourself in legal and CPA stuff. Expertise is developed over many years in business. So, the value you pay to a professional will help you alleviate any unnecessary time figuring this out for yourself and hoping you made the right decisions. The potential of losing your customers is a real concern. We have seen this before, where someone quickly set up shop on a marketplace and did not think through the long-term consequences, such as their business evolves.

Choosing the right legal structure (LLC or Inc) is not only important for liability protection and taxes but is also very important to set up when initially creating your Amazon store online.

In order to sell on Amazon, for example, you are best off having an Employer Identification Number (EIN) rather than using your Social Security Number as a DBA (doing-business-as) entity. Setting up your entity from the start is recommended because switching after you are already established on selling platforms can be very costly and time-consuming. These small details are exactly what an experienced CPA can help advise you with, and why many eCommerce business owners look to partner with a CPA early in their business growth.

Though you want a CPA who can deliver the best advice to your business, you’re also probably working with a limited budget – and are interested in getting the most bang for your buck. That’s why it’s essential that you join forces with a licensed professional, like us, from the beginning to avoid costly ‘catch-up work’ in the future as you grow.

There is a host of what we like to refer to as “craigslist bookkeepers” out there; people who advertise their services as though they are a professional, but do not actually hold a license. They also cannot provide you with the state board protections that a licensed CPA can, the same protections that provide greater transparency and allow you to trust that your information will not just ‘disappear’ one day when you are not able to get a hold of your ‘craigslist bookkeeper.’ If you decide to spend your hard-earned money on professional services, be certain that you’re getting the best professionally trusted advice and expertise.