Not sure if someone is a CPA? Just search your state board of public accountancy and look up the person’s name. Most people who call themselves “accountants” or “bookkeepers” aren’t licensed CPAs, which means you might not get the transparency and protections a CPA provides.

Having a knowledgeable CPA is just one part of the equation; the other part is ensuring your CPA understands eCommerce and its nuances. “Firms that can offer more than just compliance services will stand out as the industry evolves.” Your CPA should have the same priority as you: helping you reach your goals.

🚩 Getting Started

First on your list is to create a solid business plan. The U.S. Small Business Administration (SBA) agrees: “A good business plan guides you through each stage of starting and managing your business. You’ll use your business plan as a roadmap for how to structure, run, and grow your new business.”

Your business plan is also the first document you can show your CPA. A comprehensive business plan usually includes:

- ✅ Executive summary

- ✅ Company description

- ✅ Market analysis

- ✅ Organization and management

- ✅ Service or product line

- ✅ Funding requests

- ✅ Financial projections

But let’s be honest—how many people actually create these business plans before starting a business? In our experience, very few. The most important thing is keeping an updated cash-flow forecast.

While having a plan is a good idea, you don’t need all of this to get your first online sale. Sometimes, eCommerce businesses just happen. You buy some products, list them online, and—boom! You’re in business. Just don’t forget to hire a CPA.

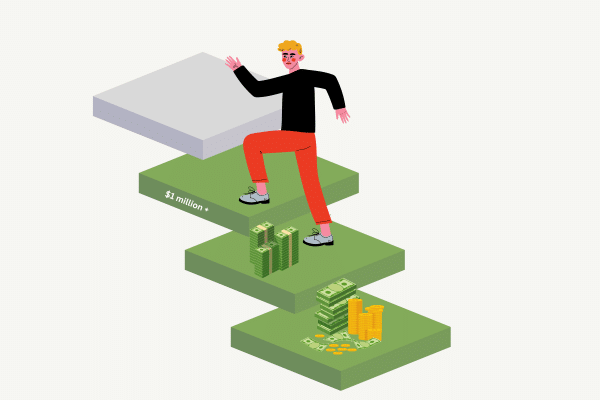

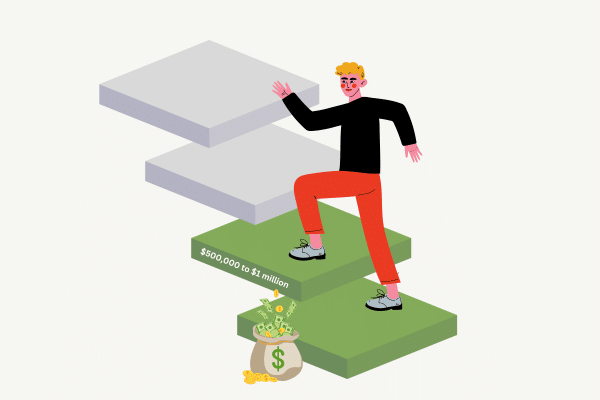

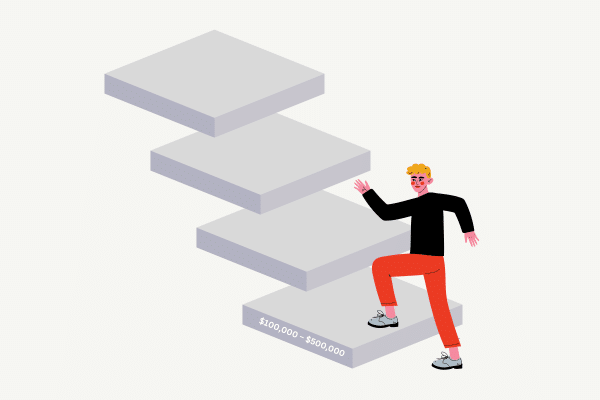

Also, consider using third-party applications to manage your multiple online selling channels; this is an area where we can help you. Many eCommerce businesses move quickly through the growth phases, and you’ll want to be ready to succeed as your business expands.

Ready to take your eCommerce business to the next level?

Our team of eCommerce accountants is here to help. Let’s make your business thrive together. Contact us now and let’s start achieving your goals!