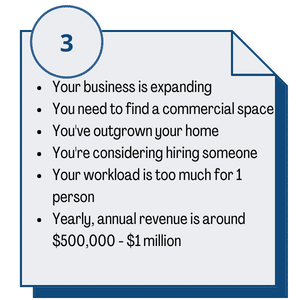

How can you keep up with your eCommerce accounting when you also have partners to meet, logistics to worry about, and a business to run? Then, as your business grows, you’ll have increased compliance requirements, new markets to enter, and compounded tax challenges.

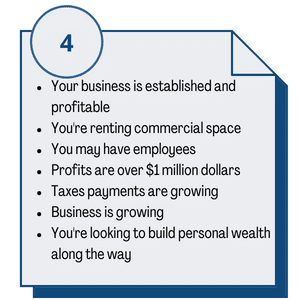

It’s impossible to do it all yourself. And, you’re not alone. Here are the top, four eCommerce business challenges we’ve identified; plus, how to solve them.

- Sales Tax Liability—Over the past few years, eCommerce sales tax has gotten more complicated for the eCommerce business owner. Online retailers need to remit tax in nearly every area in which they sell. But, some challenges do it electronically while others require specialized knowledge of tax laws.

- Seller Fees—Complex fee structures can be a challenge to track. There can be fees for transactions, listing, order fulfillment, advertising, and more. Without the right tools in place, this could leave you spinning.

- Ruinous Records—Disorganized books can cause a lot of problems, such as fraud, deceitful tactics, and internal control nightmares.

- Growing Pains and Money Management—With a limited understanding of your company’s profitability and the correct way to manage business finances, you may have a huge hurdle to cross.

With your busy schedule, the thought of trying to handle complex business accounting on your own can be overwhelming. That’s why Insogna CPA works with you to help you grow your business.

Take advantage of our expertise rather than spending time looking, hiring, and maintaining an in-house accounting team. Give us a call today.

You Might Also Like

- Avoid getting lost in the Amazon Seller digital jungle.

- Automated Bookkeeping for eCommerce Sellers

- Accounting Experts For eCommerce Sellers